The global surge in cryptocurrency adoption is reshaping the financial landscape, presenting unprecedented opportunities for Forex brokers, prop trading firms and iGaming businesses. Regions like India, Brazil and the Netherlands are at the forefront of this transformation, embracing digital currencies despite regulatory challenges and economic fluctuations. In this blog post, we’ll explore how these markets offer significant opportunities for businesses to expand their payment options through crypto, and how Match2Pay can facilitate this integration seamlessly.

India: Tapping into the World’s Largest Crypto User Base

Why It Matters:

India has skyrocketed to the leading edge of cryptocurrency adoption, with an impressive 93.5 million people—roughly 6.55% of the population—actively involved in the digital asset ecosystem. This growth represents a goldmine for Forex and iGaming businesses, providing access to a massive market of clients who are increasingly preferring or exclusively using crypto for their transactions.

Key Insights:

- High Demand for Crypto Transactions: Despite stringent regulations and high taxes, India’s population continues to embrace cryptocurrencies for their investment potential and utility in daily transactions.

- Remittances and Payments: Cryptocurrencies offer a cost-effective and speedy alternative for remittances, a significant factor given India’s large expatriate community.

- Youthful Demographics: With 65% of India’s population under 35, a tech-savvy younger generation is more inclined towards digital finance and showing a strong preference for crypto payments.

Opportunity for Businesses:

By accepting crypto deposits, Forex brokers and iGaming platforms can attract a substantial segment of Indian users looking for platforms that accommodate their preferred payment methods. This not only enhances the user experience but also positions your business ahead of competitors still relying solely on traditional payment systems.

Brazil: Navigating a Crypto-Friendly Economic Landscape

Why It Matters:

Brazil’s economic environment, marked by high inflation and banking costs, has prompted growing interest in alternative financial solutions. Cryptocurrency has gained traction, with approximately 12% of the population actively using crypto. Notably, 70% of all crypto transactions in the country this year are on stablecoins, making Brazil a strategic market for businesses willing to accept crypto payments.

Key Insights:

- Bypassing High Fees: Crypto transactions help users avoid the exorbitant fees associated with traditional banking, making them an attractive option for deposits and withdrawals on Forex and iGaming platforms.

- Growing Crypto Infrastructure: With increasing government interest and the rise of local crypto exchanges, the infrastructure supporting crypto transactions is strengthening.

- Cross-Border Appeal: For prop trading firms and Forex brokers, Brazil’s openness to crypto simplifies international transactions and expands the potential client base.

Opportunity for Businesses:

Integrating crypto payment solutions can significantly enhance your appeal to Brazilian users by addressing their need for cost-effective, efficient transactions, while positioning your platform as user-centric and innovative.

The Netherlands: Leveraging a Progressive Crypto Hub

Why It Matters:

The Netherlands is known for its progressive stance on technology and finance. The country’s crypto-friendly regulations and robust fintech ecosystem make it an ideal market for Forex and iGaming businesses aiming to incorporate crypto payments. With global cryptocurrency growth projected to reach 12.5% annually by the end of 2030, the Netherlands is well-positioned to capitalize on this trend, offering significant opportunities for businesses embracing digital assets.

Key Insights:

- Regulatory Support: The Dutch government’s supportive policies towards cryptocurrencies encourage adoption among both businesses and consumers.

- Tech-Savvy Population: A population comfortable with digital innovations is more likely to engage with platforms offering crypto payment options.

- Business Integration: Many Dutch businesses already integrate blockchain and crypto solutions, setting industry standards.

Opportunity for Businesses:

By offering crypto deposit options, you can meet the expectations of Dutch clients who are accustomed to advanced fintech solutions. This enhances user satisfaction and aligns your business with the forward-thinking Dutch market.

Why Accepting Crypto Deposits Is a Game-Changer

For Forex brokers, prop trading firms and iGaming businesses, the advantages of accepting crypto deposits are manifold:

- Global Accessibility: Crypto transcends borders, allowing you to tap into international markets without the constraints of traditional banking systems.

- Faster Transactions: Instantaneous transfers enhance the user experience, encouraging more frequent and higher-value transactions.

- Lower Operational Costs: Crypto reduces costs associated with credit card payments and bank transfers, improving your bottom line.

- Security and Transparency: Blockchain technology offers enhanced security features, reducing the risk of fraud and chargebacks.

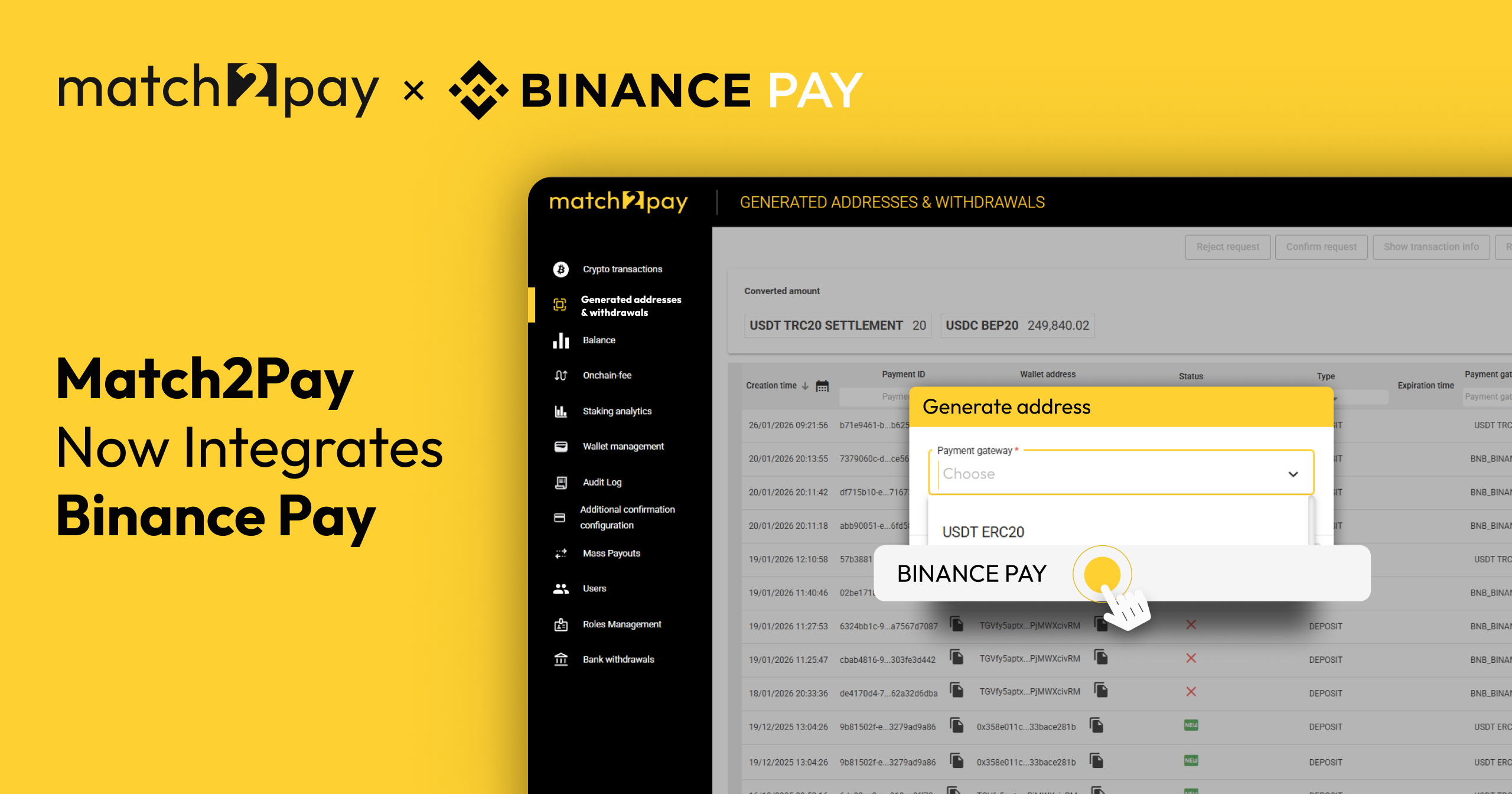

Seamless Integration with Match2Pay

At Match2Pay, we specialise in providing tailored crypto payment solutions for Forex and iGaming businesses. Our platform is designed to help you effortlessly integrate crypto deposit options, ensuring a smooth experience for you and your clients.

Features:

- Easy Integration: Integrate quickly and hassle-free with your existing systems using our API.

- Multi-Currency Support: Accept a variety of cryptocurrencies to cater to different user preferences.

- Compliance Assurance: Navigate regulatory landscapes confidently with our compliant solutions.

- Dedicated Support: Get assistance from our team of experts at every step.

Take the Next Step in Growing Your Business

The rise of cryptocurrency adoption in India, Brazil and the Netherlands presents a timely opportunity to expand your business. By embracing crypto deposits, you position your platform at the cutting edge of financial innovation, ready to meet the demands of a growing market segment.

(TRC20)

(TRC20) (BEP20)

(BEP20)