Unpredictable currency fluctuations and exchange rate uncertainity remain constant challenges for globally operating businesses. Stablecoins—cryptocurrencies designed to maintain a steady value by pegging to fiat currencies or other assets—are emerging as powerful tools for firms trying to manage these risks while keeping their operations smooth.

Key Currency Volatility Challenges

Currency volatility poses substantial risks, affecting everything from supply chain costs to profit margins. Traditional hedging through banks typically comes with high fees, complex contracts and very limited flexibility. For many organizations, these traditional solutions remain cost-prohibitive or simply inaccessible.

Stablecoins like USDT and USDC offer a compelling alternative. Tied mainly to the US dollar, these digital tokens preserve stable values while providing the benefits of blockchain technology, including transparency, 24/7 availability and programmability.

Stablecoin Strategies

Companies can bring stablecoins into their treasury operations through several approaches:

- Faster Cross-Border Payments: Transfers conclude within minutes instead of days, with much lower transaction fees compared to conventional wire transfer systems.

- Currency Hedging: Entities receiving payments in volatile currencies can immediately convert to stablecoins, eliminating overnight exposure to devaluation risks.

- Liquidity Management: Stablecoins enable businesses to hold liquid assets without traditional banking restrictions, providing flexibility for operations across time zones and borders.

Match2Pay vs Stablecoins

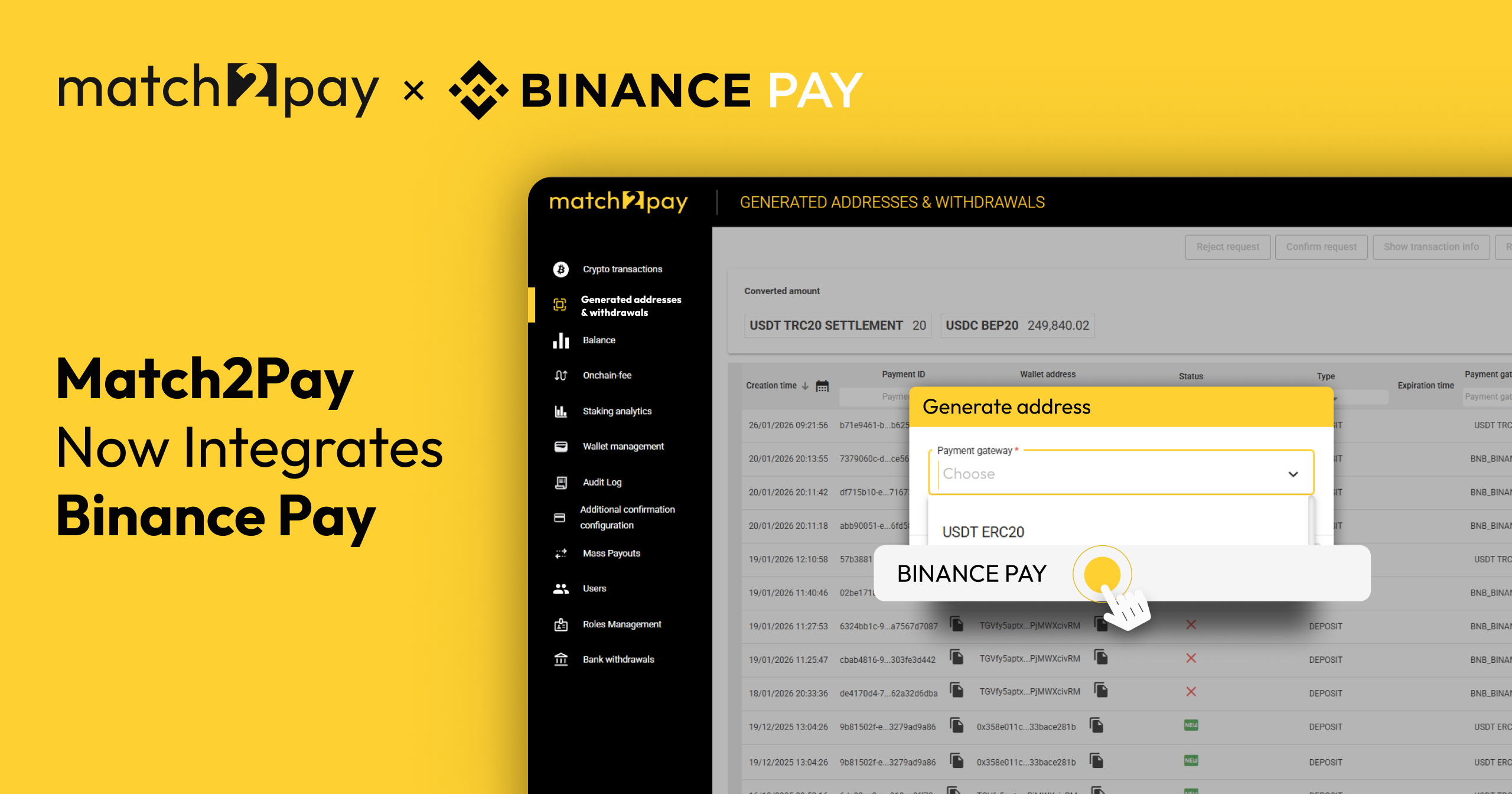

Match2Pay goes well beyond basic crypto processing with advanced currency management features:

- For users accepting volatile cryptocurrencies like BTC, the platform can automatically convert incoming payments to stablecoins, effectively eliminating price fluctuation risks.

- The system supports conversion to exotic currencies, allowing merchants to maintain currency consistency between Match2Pay and their CRM system, avoiding the FX exposure.

- Financial teams benefit from Match2Pay’s 1:1 USDT-to-USD conversion, which streamlines reconciliation and provides financial certainty. Unlike many other providers, we don’t apply the typical 0.1%–0.2% markup, ensuring full transparency and cost efficiency.

- Clients can leverage the platform as a comprehensive currency exchange service, managing their FX risk directly through Match2Pay.

- With our access to exchanges and liquidity partners, Match2Pay offers significantly better rates than traditional banking institutions, creating opportunities for strategic currency management and potential cost savings.

Future Outlook

The future of stablecoins looks robust as they continue to bridge the gap between traditional finance and blockchain technology while reshaping payment systems worldwide. Their adoption trajectory will definitely be driven by technological innovation, regulatory evolution and increasing demand for efficient financial solutions.

(TRC20)

(TRC20) (BEP20)

(BEP20)