When the EU launched MiCA in December 2024, it was supposed to bring stability to the continent’s cryptocurrency markets. Instead, it created the opposite effect. The far-reaching regulation drove away the world’s largest stablecoin and highlighted fundamental flaws in how traditional regulators approach digital assets.

The Unintended Consequences of MiCA

MiCA’s most controversial provision requires stablecoin issuers to hold at least 60% of their reserves in European Union-based banks. Designed to enhance oversight and security, this mandate has increased systemic risk and reduced global diversification options.

The regulation also imposes substantial compliance costs through Electronic Money Institution licensing requirements and extensive operational standards. These barriers disproportionately affect smaller companies and startups, while established players face a choice between costly adherence or market exit.

Tether’s Strategic Response

Tether CEO Paolo Ardoino has been direct in his criticism of MiCA, calling it “very dangerous for stablecoins like USDT” and warning that it could destabilise European banking. Rather than comply, he made a calculated decision to abandon the European market entirely and relocate Tether’s headquarters to El Salvador.

Ardoino’s objections focus on several points:

- Risk concentration: Thinks holding reserves in EU banks increases vulnerability

- Global priorities: Serves 400+ million users worldwide, mostly in emerging markets facing currency instability

- Operational freedom: Prefers diversified reserves in US Treasuries over forced EU bank deposits

- Privacy concerns: Opposes the digital euro as a potential surveillance tool

Major cryptocurrency exchanges have responded predictably. Binance, Kraken, Crypto.com and Coinbase have all delisted USDT trading pairs for European users. Europeans can still hold USDT, but trading it on regulated platforms is now impossible. They also face potential liquidity issues since the broader European crypto ecosystem has lost access to the world’s most widely used stablecoin.

The Seychelles Advantage

Meanwhile, jurisdictions like the Seychelles have shifted economic activity from high-regulation to more business-friendly environments. The island nation’s Virtual Asset Service Provider (VASP) framework, overseen by the Financial Services Authority, requires proper licensing and anti-money laundering compliance while avoiding the operational constraints that have made MiCA problematic. Leading cryptocurrency players have established operations there, creating a robust ecosystem that serves international markets.

Key advantages of the Seychelles framework:

- Clear rules and straightforward licensing processes support rather than hinder business growth

- No mandated reserve concentration requirements allow companies to manage risk according to their risk management frameworks

- Compliance with Financial Action Task Force (FATF) guidelines and other international standards without the bureaucratic overhead seen in other jurisdictions

Looking Forward

MiCA’s implementation demonstrates how well-intentioned regulations can backfire when they ignore the global, borderless nature of digital assets. Tether’s decision underscores the rising trend of choosing favourable regulatory environments—more crypto companies are opting for jurisdictions that encourage innovation rather than those trying to fit new technologies into outdated frameworks.

The European experience serves as a warning for other major economies as they develop crypto regulations. Effective oversight requires striking a balance between consumer protection and market accessibility—overly restrictive approaches often fail at both. The most successful regulatory frameworks will achieve necessary oversight without driving innovation offshore.

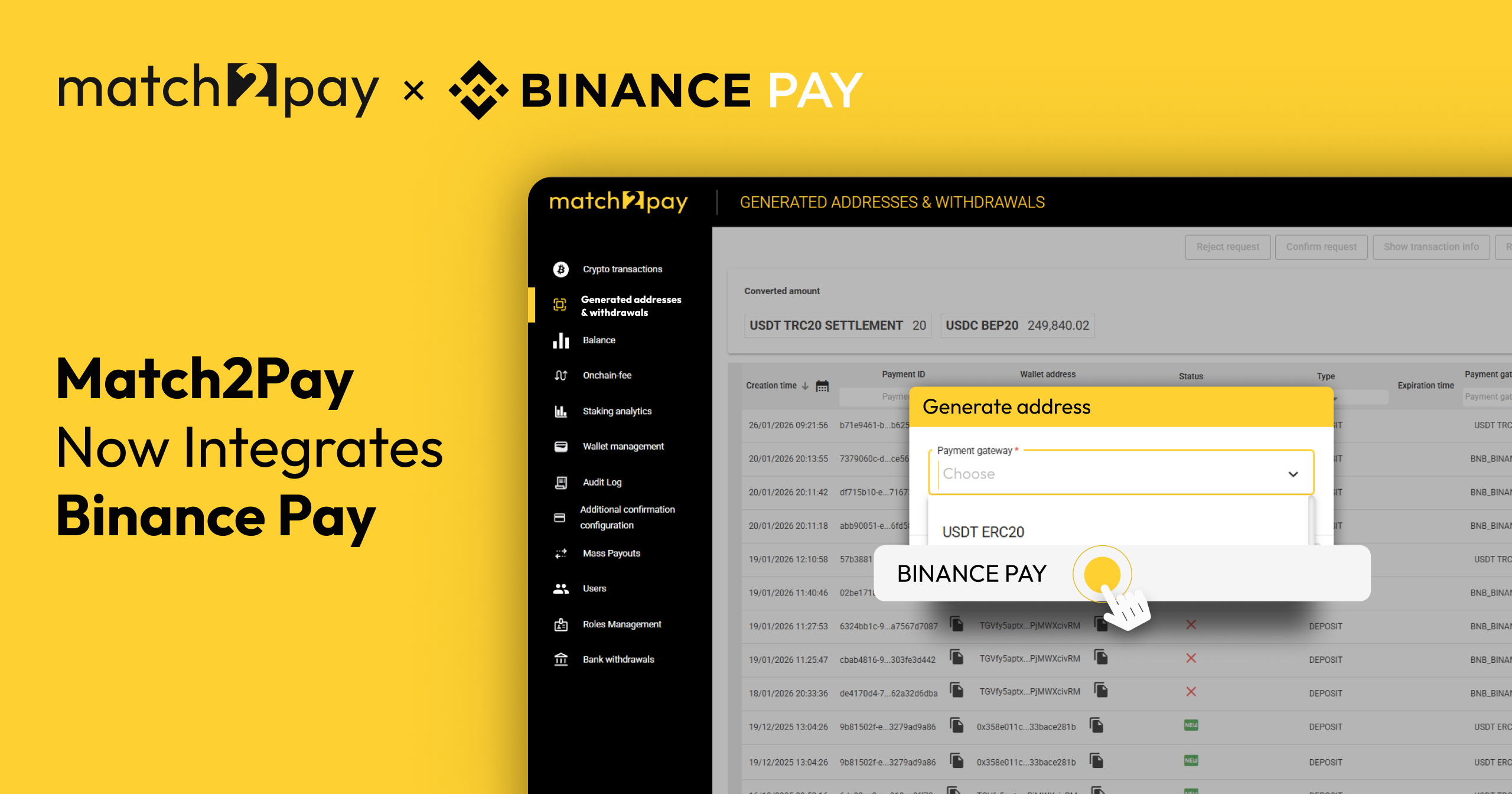

Want to learn more about regulations affecting the world of crypto? Contact the Match2Pay team!

(TRC20)

(TRC20) (BEP20)

(BEP20)