The growing trend of cryptocurrencies is currently shaping the financial world as we know it. Its growth potential is drawing the attention of investors and, as a result, attracting financial criminals.

Not that long ago, the biggest crypto exchange in the world, Binance, was hacked, and $570 million worth of Binance’s BNB token was stolen.

To combat illicit activities in the fast-evolving financial landscape, new laws and regulations are being introduced worldwide.

Due to adopting the 5th Money Laundering Directive (5AMLD) in May 2018, Virtual Asset Service Providers (VASPs) become bound by AML/CFT laws and regulations.

Furthermore, together with newly introduced directives and recommendations from international organisations for global money laundering and terrorist financing prevention, such as The Financial Action Task Force (FATF), countries started implementing country-based requirements for VASP activity. In 2020, the Lithuanian Financial Crime Investigation Service (FCIS) presented a new regulation concerning businesses seeking to offer services related to digital assets. This is one of the first attempts to regulate cryptocurrencies in the European Union (EU). Although there is no licensing for Virtual Asset Service Providers (VASPs) in Lithuania, newly established companies must apply for VASP authorisation. Applicants must have all necessary AML/KYC policies and procedures for the provision of virtual assets-related activities. Obtaining the authorisation allows businesses to offer crypto-related services in the legal field of the EU.

The European Union’s Markets in Crypto Assets (“MiCA”) legislation

The European Union’s Markets in Crypto Assets (“MiCA”) legislation is a significant step toward standardised policies allowing countries throughout the European Union to stabilise their financial systems. MiCA is conceivably the first extensive regulatory framework explicitly developed for crypto-assets.

The main objectives of the proposed legislation are consumer and investor protection and market integrity, support for innovation, financial stability, and legal certainty.

The fact that regulation (and not a directive, which could be transposed with interpretations/additions from the countries that it applies to) was chosen as the means of legislation suggests that this area is even more harmonised than other financial services.

The number of countries trying to include virtual asset providers in their legal framework is increasing. This is because the highly active cryptocurrency sector will introduce a number of new areas of litigation, and crypto exchanges are set to become a new target for claims. Is Lithuania the one that will be leading the way?

More about the Lithuanian regulation

The Lithuanian government qualifies virtual assets based on the following: depending on the corporate structure, crypto assets qualify as financial instruments under the Investment Services and Activities Act or electronic money under the Electronic Money Act.

As noted on the FCIS website, since January 2020, Virtual Currency Exchange Operators and Depository Virtual Currency Wallet Operators, widely known as VASPs, must comply with the Law on the Prevention of Money Laundering and Terrorist Financing of the Republic of Lithuania. For VASPs, it means implementing the client due diligence, ongoing monitoring and reporting procedures.

In 2021 and particularly in the first half of 2022, the number of newly established VASPs in Lithuania has increased significantly due to the relatively simple and fast company registration and licensing procedure. However, since the recent regulatory updates require increasing share capital from 2.5k EUR to 125k EUR, the Lithuanian cryptocurrency market will become more robust and more reliable.

As the cryptocurrency sector grows, growing demand for such services is expected. Speaking of which, what are the main benefits that attract market participants to focus on digital assets?

The growing importance of digital assets

- Fast Transactions

The fact that cryptocurrencies do not require an intermediary makes the transaction process faster and easier, even if they are international.

- Privacy and Security

By using cryptos, anyone can transact anonymously since there is no need to work with a bank institution. This means that there is no need for extra paperwork.

- Transparency

Crypto was designed and run by a blockchain program so no one could manipulate it. Every transaction is recorded and available for all to see.

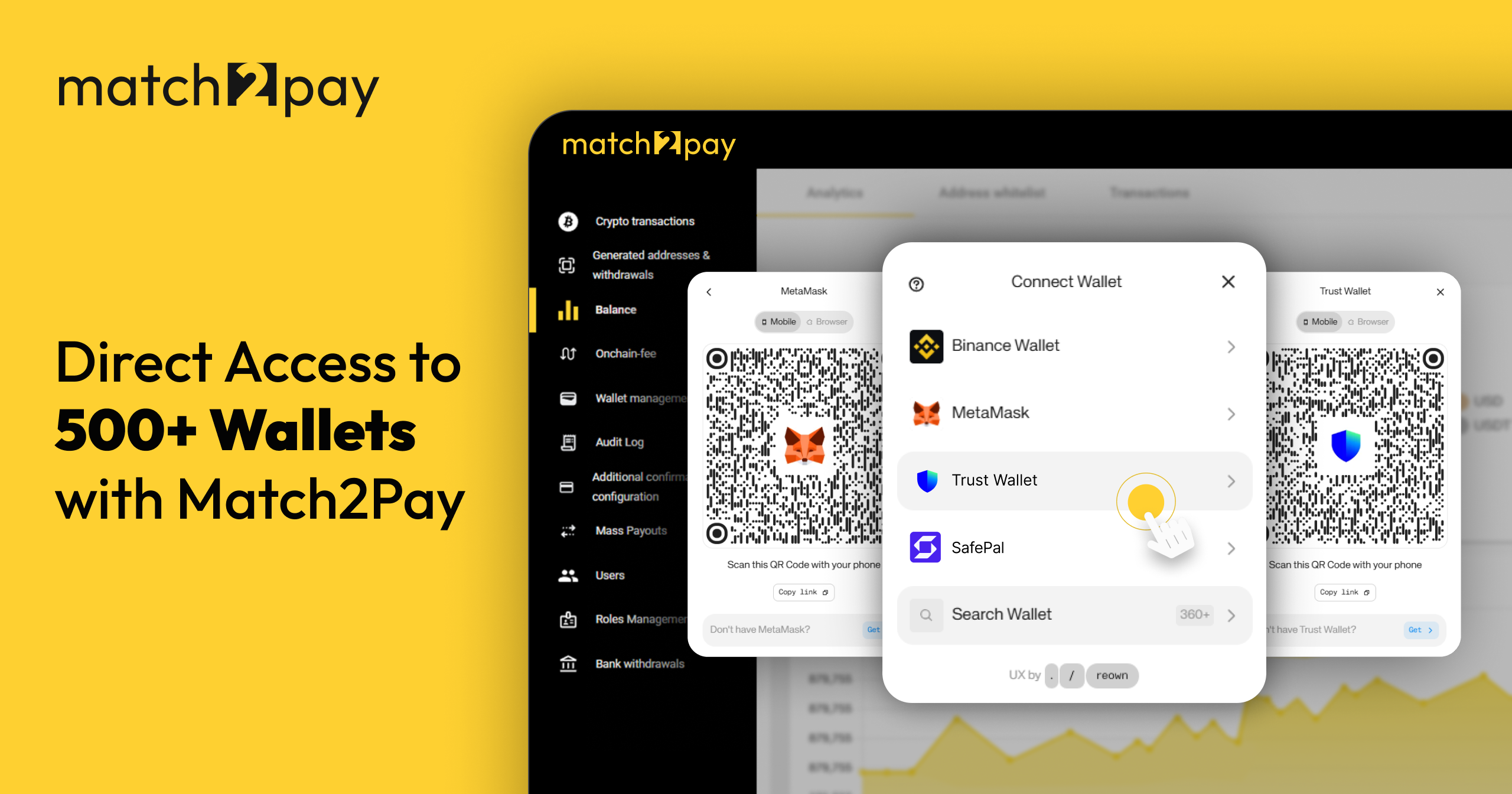

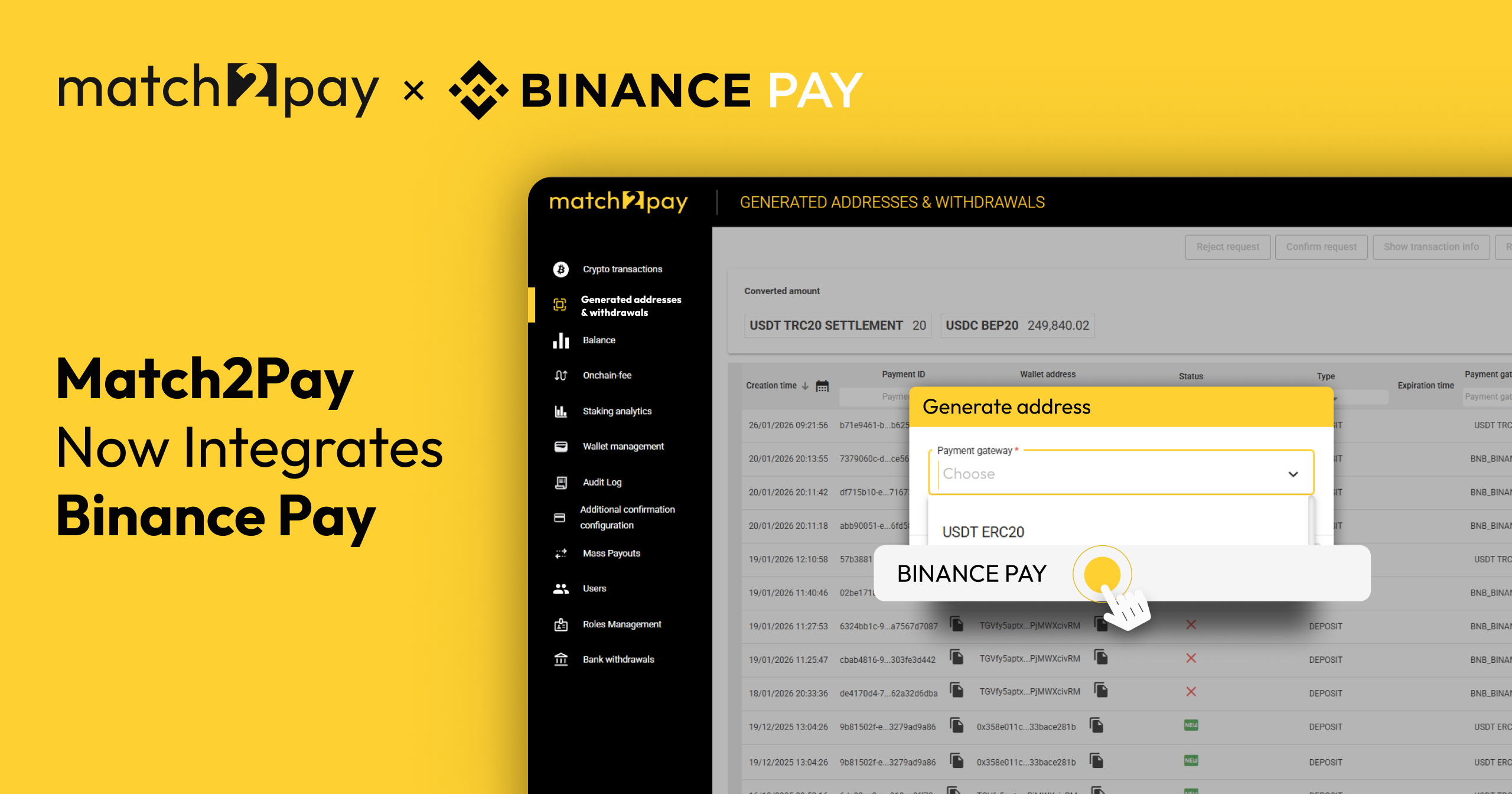

Match2Pay UAB is a virtual currency exchange operator and the depository virtual currency wallet operator registered in Lithuania. If you are interested in a fast and reliable multi-crypto payment solution, do not hesitate to contact us.

(TRC20)

(TRC20) (BEP20)

(BEP20)