The choice of an appropriate cryptocurrency payment gateway for your business is a critical decision that can shape customer trust, operational resilience and your competitive advantage. As blockchain technology matures and crypto adoption accelerates, understanding the key factors that should guide your selection process is essential. This practical guide outlines what to look for in a crypto payment processor in 2025.

Elements of a Reliable Crypto Payment Gateway

Security Architecture

In the cryptocurrency ecosystem, security isn’t simply a feature but the foundation upon which all else rests. When evaluating potential payment processors, prioritise those offering:

- Robust encryption protocols with comprehensive threat monitoring systems

- Two-factor authentication (2FA) that prevents unauthorised access

- Cold wallet storage solutions to protect assets from online threats

- Support for multi-signature wallets for enhanced transaction security

Asset Diversification

Cryptocurrency diversity is about creating optionality in an evolving digital asset landscape. Your processor’s supported crypto portfolio directly correlates with your potential customer base and operational flexibility:

- Core assets (Bitcoin and Ethereum) remain essential, collectively representing nearly 75% of global crypto holders

- Stablecoin integration (USDC, USDT) helps mitigate volatility and simplifies accounting processes

- Multi-chain compatibility across Ethereum Virtual Machine networks (Ethereum, Base, Arbitrum) and other L1 protocols enables cross-ecosystem transactions

Regulatory Compliance

As cryptocurrency regulations evolve across jurisdictions, choosing a compliant processor protects your business from legal complications:

- Verify implementation of KYC (Know Your Customer), AML (Anti-Money Laundering) and transaction monitoring systems

- Examine licensing credentials in key jurisdictions

- Evaluate the processor’s regulatory adaptation history and track record of compliance innovation

Transaction Processing and Settlement Options

Transaction processing speed and settlement flexibility directly impact working capital efficiency and customer experience:

- Look for processors offering instant or near-instant payment confirmations

- Evaluate crypto-to-fiat conversion capabilities and settlement timeframes

- Check for direct bank transfer options via SEPA, SWIFT or similar systems

- Consider processors supporting stablecoin settlements to reduce volatility risks

Intelligent Reporting Tools

Organisations with data-driven decision frameworks recognise that sophisticated reporting capabilities transform payment data into strategic insights:

- Look for processors offering detailed transaction analytics and customisable reporting dashboards

- Ensure the system provides exportable data in formats compatible with your accounting software

- Verify multi-currency reporting sophistication to handle conversion complexities

- Check for real-time monitoring systems that track payment status, settlement progress and potential anomalies

Architectural Scalability

As transaction volumes grow, your payment infrastructure must scale proportionally. Selecting a processor with built-in scalability eliminates future migration complexity and provides long-term technological stability:

- Verify the processor’s capacity to handle increasing transaction volumes

- Seek advanced features such as batch processing, automated invoicing and multi-currency wallets

- Assess the processor’s roadmap for future feature development and innovation

Withdrawal Options and Speed

Frictionless access to funds represents a critical operational consideration. Efficient withdrawal mechanisms ensure capital remains available when needed:

- Compare withdrawal execution timeframes across processor options

- Check for one-click withdrawal capabilities for high-volume operations

- Verify compatibility with your preferred banking systems

- Consider processors offering multiple withdrawal methods for added flexibility

What Makes Match2Pay Stand Out

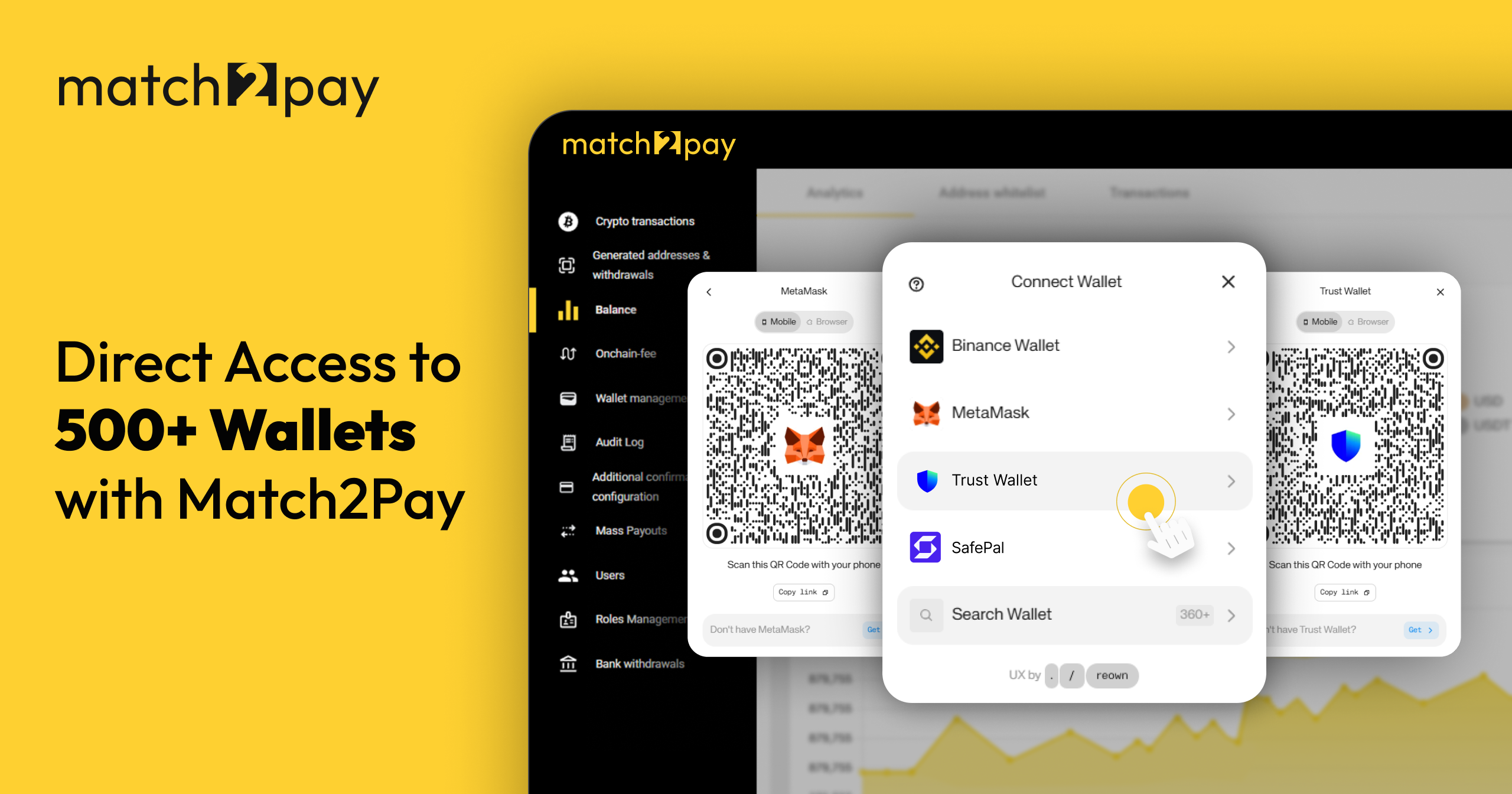

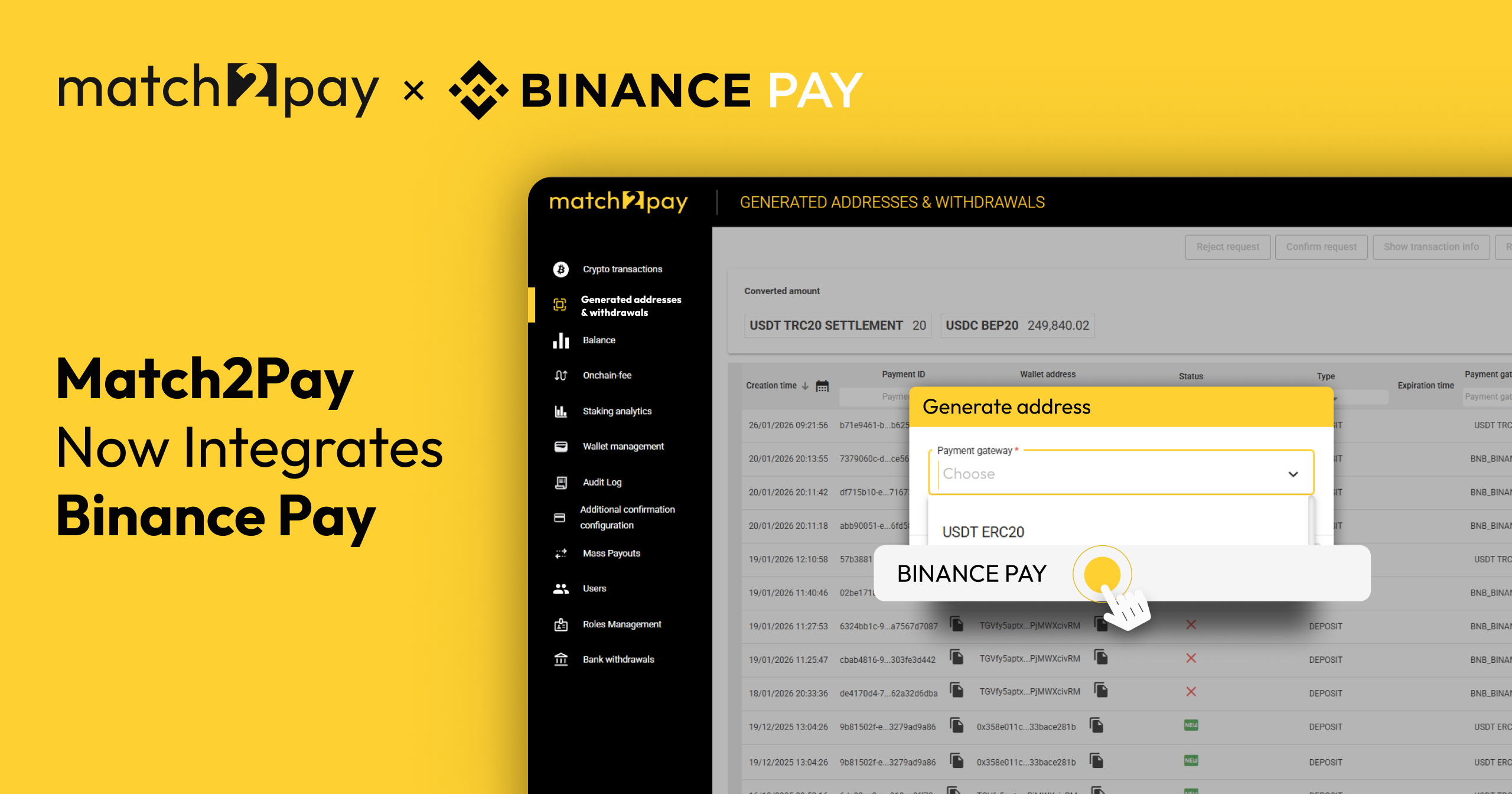

Match2Pay is a leading crypto payment processor that distinguishes itself through exceptional security, transparency and cost-effectiveness, benefiting organisations of all sizes. Among its advantages are:

- True 1:1 USDT-to-USD conversion with no hidden markups, unlike many other providers

- Competitive fee structure with transparent pricing

- Own technology with in-house nodes, removing reliance on third-party platforms and enabling scalable solutions for businesses from e-commerce to banking institutions

- White-label customisation with full branding capabilities and flexible templates to maintain brand coherence

- Premium support infrastructure offering 24/7 technical assistance through multiple channels, dedicated account managers and personalised service

- User-centric design with intuitive admin dashboards and a device-optimised checkout process

- Access to exchanges and liquidity partners, offering significantly better rates than traditional banking institutions

Want expert advice on choosing a crypto payment processor? Contact our team!

(TRC20)

(TRC20) (BEP20)

(BEP20)