Blockchain technology is revolutionising financial systems globally, and Africa is no exception. At the recent Finance Magnates Africa Summit (FMAS:24), industry experts gathered to discuss the transformative power of blockchain in enhancing financial inclusion across the continent. Moderated by Melisa Slaymaker, Global Partnership Director at Women in Tech, the panel delved into the opportunities and challenges that blockchain presents for Africa’s underserved and unbanked populations. As global markets evolve, the potential for blockchain to revolutionise financial access in Africa emerges as a compelling narrative. Here’s a closer look at their insights.

The African Advantage

Wiehhan Olivier, Partner & Head of Fintech & Digital Assets at Mazars, emphasised the unique position of Africa in leveraging blockchain technology. With a significant portion of the population underserved by traditional financial institutions, blockchain offers a decentralised solution that aligns perfectly with the continent’s needs.

“Bitcoin was created to facilitate peer-to-peer payments without intermediaries,” Olivier noted. “This decentralised aspect is crucial for Africa, where a large migrant workforce and lack of infrastructure create a natural synergy with blockchain technology.”

Ricky Barnes, Head of Blockchain Enabler at FirstRand Bank, provided a comparative analysis of blockchain adoption in South Africa versus other regions like the US, Asia, and Europe. While Africa focuses on practical applications such as payments and value storage, other regions explore more complex decentralized finance (DeFi) solutions.

“In South Africa, the focus is on making financial services cheaper, easier, and more accessible,” Barnes explained. “Globally, we see more government involvement and institutional use cases, which could offer insights for Africa to leapfrog some challenges.”

Overcoming Regulatory Hurdles in in Blockchain Adoption

Regulation remains a double-edged sword in the blockchain space. Olivier discussed how South Africa’s regulatory landscape has evolved, adopting a “wait-and-see” approach to understand the impact of blockchain before imposing strict regulations. “Appropriate regulation can protect consumers and encourage adoption,” Olivier said. “However, premature or overly stringent regulations can stifle innovation and limit access to blockchain services.”

Enhancing Access to Financial Markets

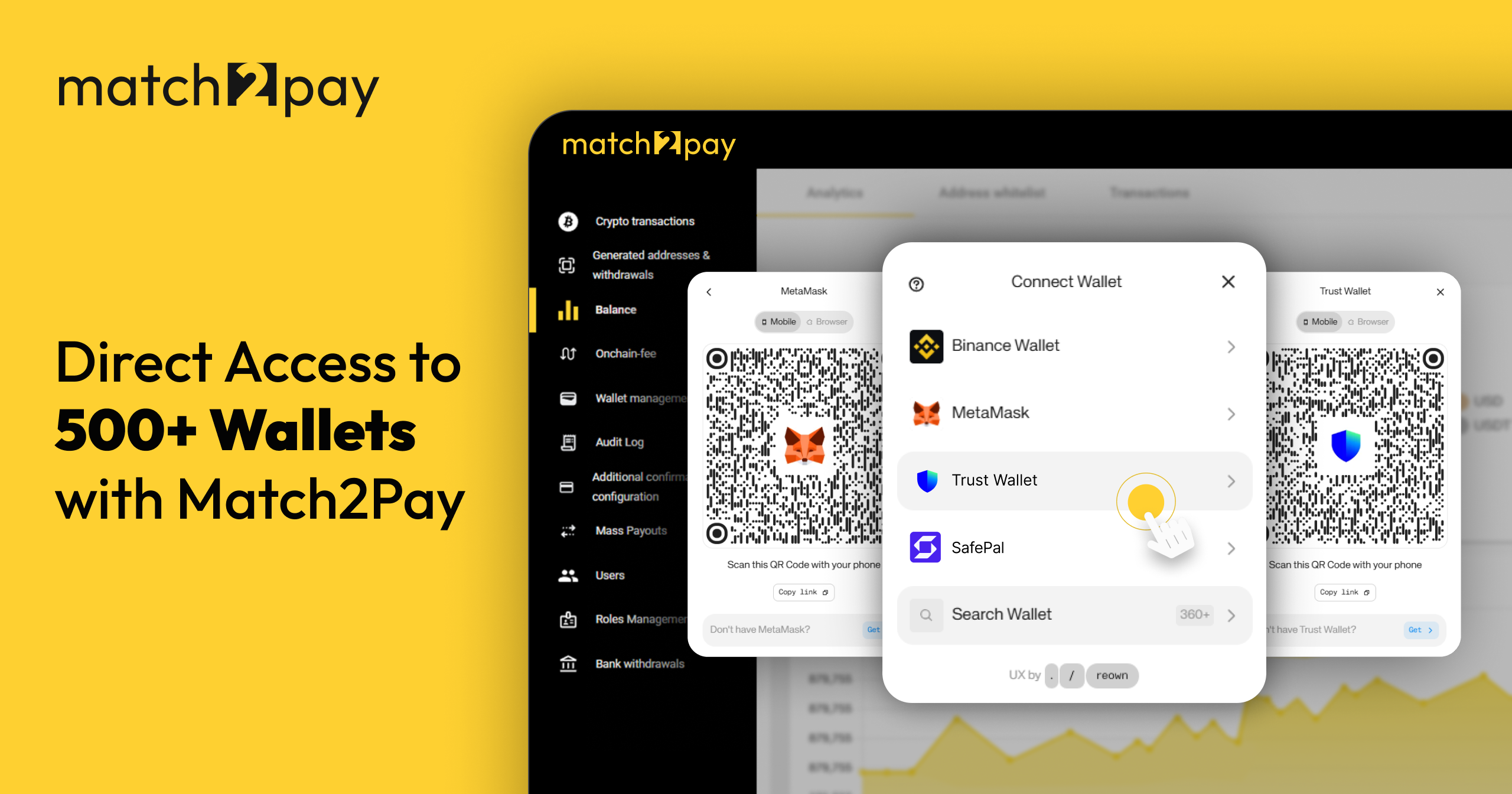

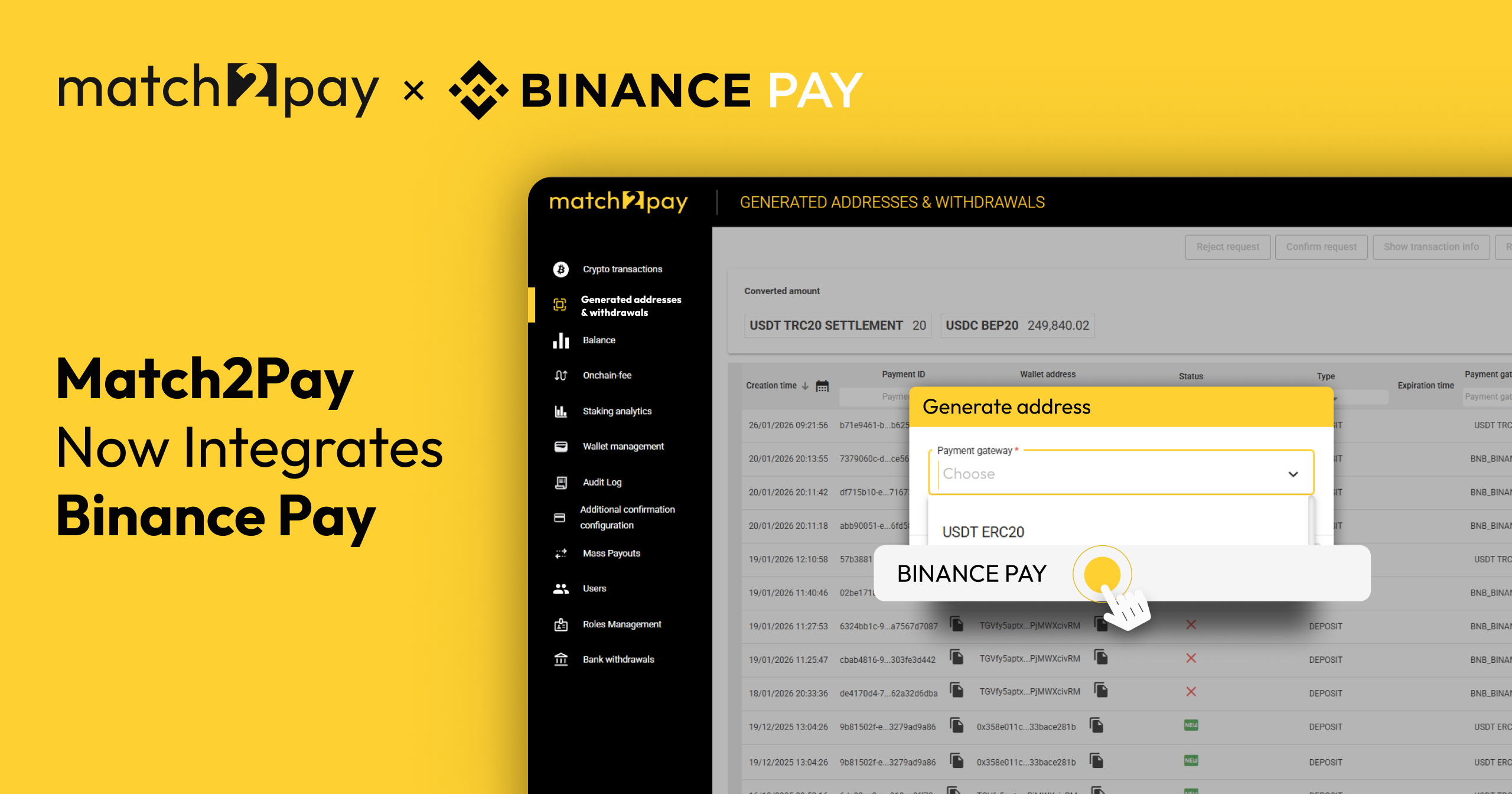

When asked how digital currencies can improve access to financial markets for retail investors in Africa, Przemysław Wojtyna, Head of Sales at Match-Trade Technologies ( ex. Head of Business Development at Match2Pay) highlighted the transformative potential of cryptocurrencies. “When we speak about cryptocurrencies and investing, everybody thinks first about speculating about buying different tokens, but very often we forget about the very crucial part – payments.”

He pointed out that in many African countries, unstable local currencies and limited access to reputable currencies like the US dollar pose significant challenges. Stablecoins offer a solution by providing a way to preserve value. “Before blockchain, before crypto, before stablecoins, people didn’t often have a way to save what they already have,” he said.

Przemysław also noted the benefits of unhosted wallets, which, despite their controversy, can protect users from mismanagement by exchanges. “Unhosted wallets are another important aspect of it, but I think the most important is the price. The ease of cross transactions even with recent surges in onchain fees, still it’s so much cheaper than Swift,” he added.

Digital currencies allow investors and traders to access global markets without being confined to brokers in their own countries, leading to increased competition and better trading conditions. “Thanks to digital currencies, clients from here—like investors and traders—they don’t need to choose the broker in their country necessarily anymore. They can check the offer, they can have access to global markets.”

Balancing Decentralization and Regulation

Andrew Matushkin, Head of Business Development at B2Broker, addressed the challenges of maintaining decentralization while ensuring regulatory compliance. He argued that a transparent legal framework is essential for traditional businesses to adopt blockchain and crypto technologies.

“Governments need to see blockchain as an opportunity, not just a challenge,” Matushkin asserted. “By regulating the space effectively, they can attract capital and innovation, benefiting the broader economy.”

The Unbanked and Wallet-Based Commerce

Barnes returned to the discussion, focusing on how blockchain can serve Africa’s unbanked populations. He noted that mobile wallets, widely used across the continent, can be integrated with blockchain to provide financial services without traditional banking infrastructure.

“Access to financial services doesn’t necessarily require a bank account,” Barnes explained. “Blockchain can leverage existing mobile networks to offer decentralized financial solutions.”

The insights from this panel highlight a pivotal moment for Africa’s financial systems. With the right strategies, blockchain can drive significant progress towards a more inclusive and accessible financial future for the continent.

The Future of Blockchain in Africa

Looking ahead, Przemysław expressed optimism about the future of blockchain technology. “Blockchain will be with us. It has a bright future. We are just at the beginning. We still didn’t use it fully. Basically, it’s an amazing database which allows the mix between booking transactions but also transparency.”

He envisioned practical applications of blockchain, such as land registers, which could simplify the exchange of plots without constant government involvement. “We could see in a few years land registers being run on blockchain, which makes it much easier to exchange the plots between people with just having some infrastructure but not necessarily each time the government being involved.”

To realise blockchain’s potential in Africa, certain challenges must be addressed. Przemysław highlighted the need for improved internet access, noting, “The first thing we have to solve in Africa is internet access. It’s still around 43% versus 66% globally.”

Additionally, establishing robust regulatory frameworks is crucial for ensuring customer protection and compliance with anti-money laundering (AML) measures. “We already see the push for AML globally. We also will see more customer protection, but this has to come from United States, more than a global initiative.”

Przemysław also pointed out the importance of solving issues related to the travel rule and data privacy. He expressed hope that innovative solutions will emerge to keep sensitive information encrypted on the blockchain without the need for additional databases. “I still think that we will see bright minds who will create a way to keep this information on the blockchain being coded and not accessible to everyone.”

The future of blockchain in Africa looks promising, with the potential to significantly enhance financial inclusion and market access for retail investors. Key steps include improving internet access and establishing robust regulatory frameworks. As these challenges are addressed, blockchain technology will likely become an integral part of Africa’s financial infrastructure, driving economic growth and development across the continent.

Watch the full panel discussion here: https://www.youtube.com/watch?v=LcFzh7EmGqk&t=1866s

(TRC20)

(TRC20) (BEP20)

(BEP20)