Every transaction through traditional payment rails costs you more than it should. Between acquiring fees, cross-border charges and middleman markups, you’re losing serious money. Cryptocurrency processing flips this equation, delivering the same results for a fraction of the price.

Traditional Payment Gateway Fees vs Crypto Processing Costs

Traditional payment systems stack multiple fee layers that can significantly impact your bottom line as a Forex trader or iGamer. Acquiring fees alone range from 1.8% to 3.5% per transaction. Payment aggregators like PayPal tack on another 2.9% to 3.9%, plus potential cross-border fees of up to 2%. International transfers through SWIFT may cost up to $50 per transaction, including intermediary bank fees.

Cryptocurrency payments offer a smarter, more cost-effective alternative—they involve two distinct types of fees with no hidden markups or middlemen.

- Processing fees for low-risk crypto transactions are usually between 0.1% and 1%, covering essential services such as compliance, security, liquidity and fiat conversion.

- Miners or validators are paid gas fees directly to carry out operations on the blockchain. They vary with network congestion but are fully visible and avoid the unpredictability of traditional financial rails.

Can Gas Fees Be Eliminated?

Gasless transactions flip the blockchain script entirely, allowing users to perform transactions without paying traditional gas fees. Instead, third parties—application developers, relayers or platforms themselves—sponsor these fees, making blockchain interactions smoother and more accessible. This shift can significantly lower the entry barrier for users in different environments, including iGaming and trading platforms.

How It Works

Gasless transactions use meta-transactions with a relay mechanism:

- The user signs transactions off-chain with their private key, without including any gas payment

- A relay server catches the signed transaction and submits it to the blockchain, covering gas fees

- Smart contracts verify authenticity to confirm the real sender

- The transaction executes normally while keeping blockchain interactions trustless

Additional Ways to Cut Transaction Processing Costs

Crypto payments deliver immediate savings, but there’s even more potential when you tap into the technology’s full strengths.

The way crypto processing works creates natural cost advantages that traditional payments simply can’t match. Once a crypto transaction is confirmed, it’s irreversible, which eliminates chargebacks or other surprise fees months later. This is especially valuable for high-risk sectors like iGaming and Forex, where chargebacks occur more frequently than in many other industries, with average rates ranging from about 6% to as high as 10%. You’ll also notice the difference in cash flow. Instead of waiting days for traditional bank transfers to clear, crypto settlements happen in minutes.

The role of stablecoins in international operations deserves particular attention for businesses handling cross-border payments. Unlike traditional volatile currencies, they provide price stability while maintaining the speed and cost advantages of blockchain technology. In contrast, traditional card processors not only retain a rolling reserve of roughly 10% of every transaction but also take up to seven days to release the remaining funds, stretching your cash-flow cycle.

It’s worth highlighting that crypto processors aren’t all created equal. Many payment gateways introduce hidden currency conversion markups that can quietly erode the savings crypto adoption was meant to provide. Processors with transparent exchange rates—like Match2Pay—help businesses avoid these surprise fees, which is particularly important for international transactions that form the backbone of global trading and digital gaming.

Ready to Reduce Your Payment Processing Fees?

The numbers don’t lie—traditional payment processors often push total costs above 8% per transaction. Crypto solutions cut through this complexity with transparent pricing and immediate savings. The question isn’t whether crypto payments will become standard—it’s when you’ll make the switch.

Want to learn how Match2Pay can help trim your payment processing costs? Schedule a quick call with our team!

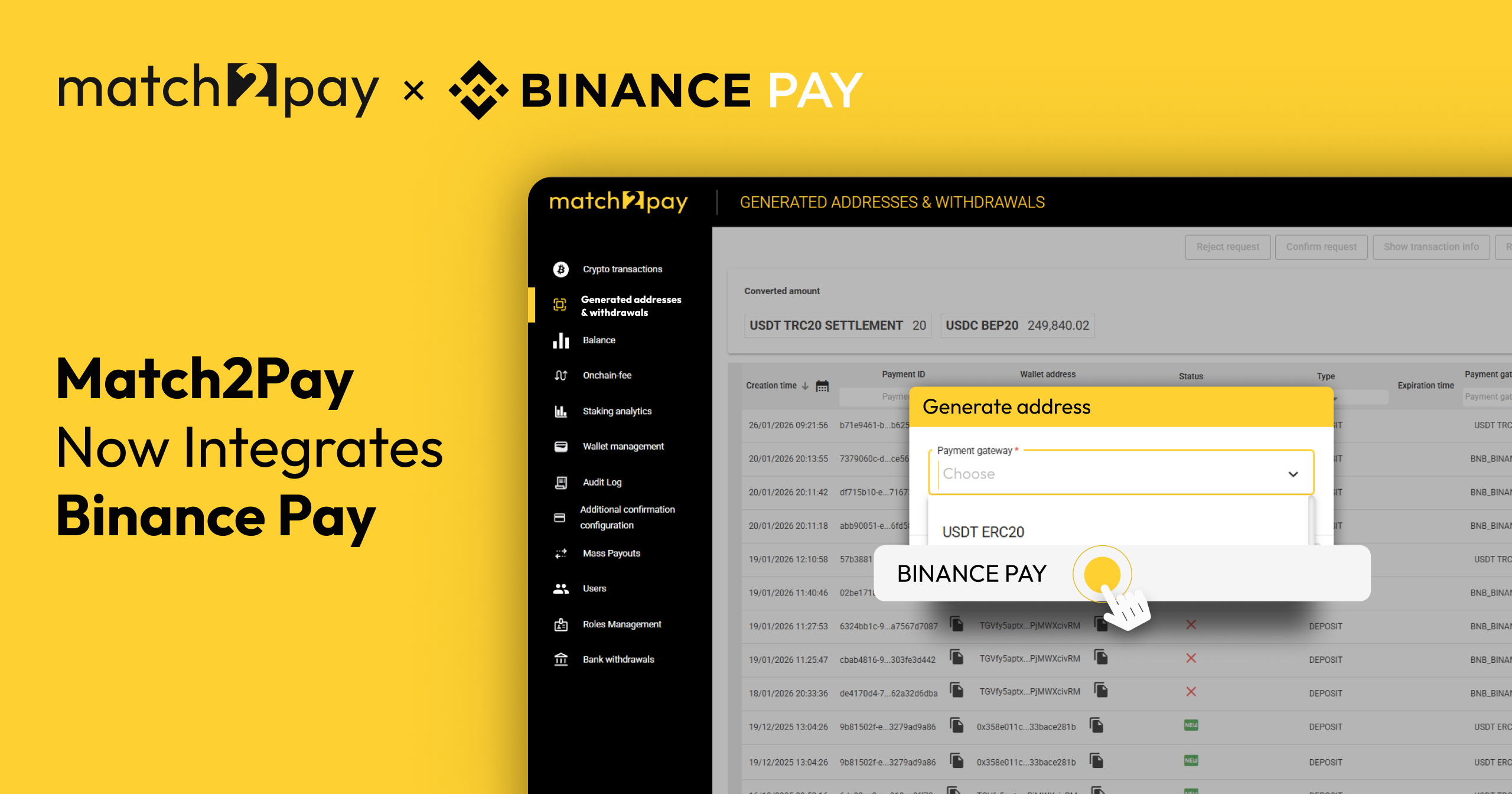

(TRC20)

(TRC20) (BEP20)

(BEP20)