The MiCA (Markets in Crypto-Assets) regulations introduced by the European Union represent a groundbreaking step towards unifying cryptocurrency regulations across the entire community. MiCA establishes uniform rules aimed at better protecting investors and organising a market that has so far been minimally regulated, mainly at the national level.

Understanding MiCA’s Purpose and Its Impact on the Forex Industry

As emphasised by the European Securities and Markets Authority (ESMA), “MiCA establishes a unique regulatory environment in the EU for crypto-asset companies, offering greater transparency regarding general rules for market players. The aim is to ensure transparency, uniformity, and security in digital assets.” However, these changes, while promising order and standardisation, may pose a challenge for crypto-friendly companies.

MiCA covers a wide range of entities, from custodial wallet providers and exchanges facilitating cryptocurrency transactions to advisory and portfolio management firms. Each of these entities must comply with the new, stringent requirements, which may entail significant operational changes and potentially increased business costs, affecting traders as well.

The planned changes also serve as a prompt for forex companies, both brokers and service providers, to rethink their strategy to ensure operational liquidity and favourable terms for their clients. However, will such strict regulations truly bring more benefits if even large players in the cryptocurrency industry today are questioning their ability to comply with the proposed changes? In this article, we will examine which issues may prove crucial, especially for Forex Brokers, in the coming months.

Crypto Travel Rule – New Requirements Alongside MiCA

Another revolutionary aspect of the crypto-assets regulations, alongside MiCA, is the Travel Rule, which requires crypto service providers to collect and transmit information about the sender and recipient of each cryptocurrency transaction. Although this regulation is a step towards increased transparency and security, its implementation could complicate the operational processes of many companies, particularly those relying on the free flow of cryptocurrencies between different platforms and wallets. In response to these challenges, service providers need to implement solutions that ensure compliance with the regulations while minimising the burden on their customers.

EURC as a Response to MiCA Requirements

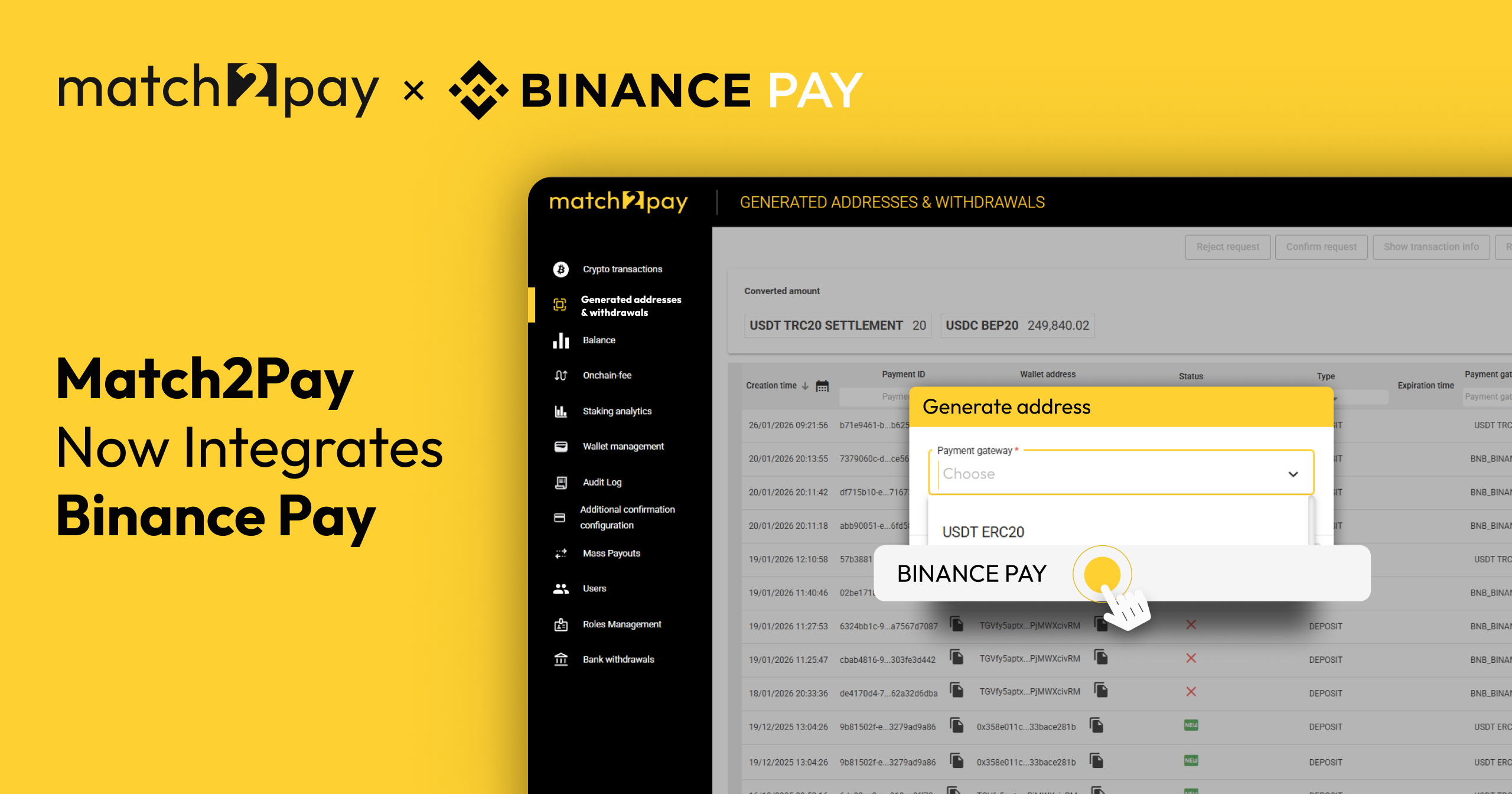

The introduction of EURC deposit support by Match2Pay, a European stablecoin, is an example of a proactive approach to new regulations. This is a step aimed at facilitating cryptocurrency settlements in the context of increasingly complex regulatory requirements. With EURC, brokers will have the ability to conduct transactions in euros with full value protection, in line with MiCA’s guidelines on stablecoins. This strategic solution not only enhances regulatory compliance but also minimises the currency risk that brokers often face.

Understanding MiCA Regulations is the Key to Success

Preparing for the upcoming changes requires not only investment in new technologies but also an understanding of the potential impact MiCA may have on the entire forex industry. The introduction of stricter regulations forces brokers and payment service providers to adapt their operations to new standards. However, those who can identify and implement the appropriate solutions early on will not only be able to maintain their competitiveness but also use the new regulations as an advantage in their operations.

The Match2Pay team, as an experienced partner in the forex industry, understands these challenges and is already working on solutions to help brokers meet the new requirements and leverage the upcoming changes to their advantage.

Broker-Friendly Features in the Match2Pay System

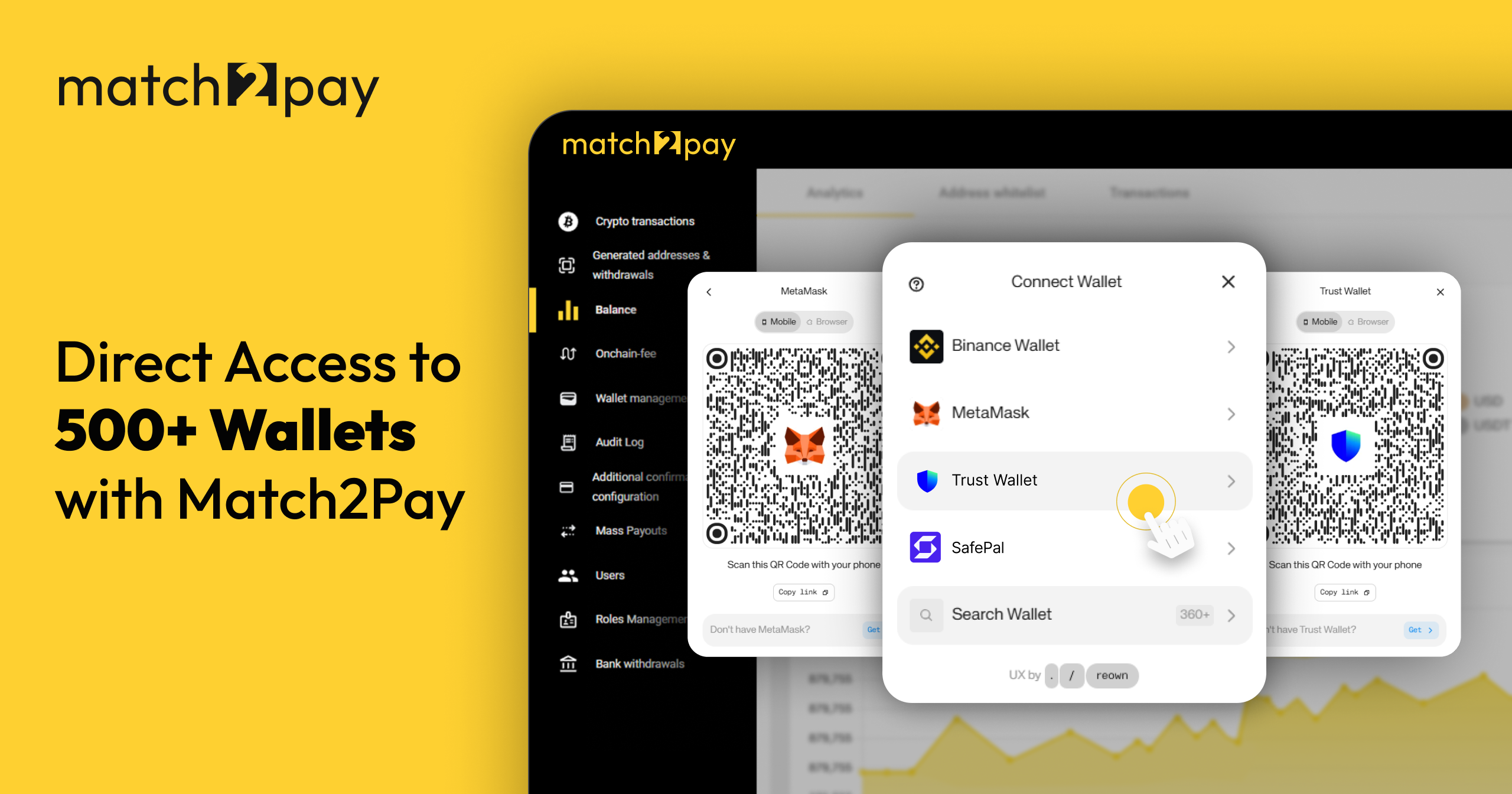

The Match-Trade Technologies team, a technology developer for brokers for 11 years and the software creator for their partner, crypto payment processor – Match2Pay, has long been adapting its system and operational approach to minimise the business risks of its clients, understanding the direction of long-anticipated changes. Currently, we are focusing on developing our IT solutions to simplify the settlement process and increase flexibility in managing cryptocurrencies by forex brokers from the Match2Pay panel, which will not only improve security but also streamline operational processes and liquidity management. This will enable brokers to manage their funds more efficiently and conduct transactions globally without unnecessary delays and complications. These are key conveniences in the new regulatory reality, which requires brokers to ensure greater transparency and better safeguards.

What Should Brokers Expect from Technology Providers Regarding MiCA?

As a proprietary technology provider offering the Match-Trader trading platform, Forex CRM, and crypto payment processor (used by our partner – Match2Pay), we have created a fully integrated technological environment, allowing for seamless cooperation between systems, quick adaptation to changing needs, and ensuring a high level of security within our system.

- Comprehensive Solution, Seamless Integration

When brokers are forced to comply with new regulations, collaboration with a single technology provider responsible for all key operational systems is invaluable. This way, brokers can be assured that their systems are fully integrated and compliant with regulations, eliminating the risk of discrepancies and compatibility issues.

- Operational Cost Optimization

Consolidation of services in one place means lower costs compared to using multiple providers. Additionally, as the creator of Match2Pay technology, we have the flexibility to expand and adjust functionalities according to the needs and requirements of brokers.

The Future in the Face of MiCA

It is predicted that MiCA’s stringent requirements may prompt many companies to seek alternative solutions due to the excessive burden on their businesses. Similar to the case of ESMA’s introduction of leverage restrictions, when many forex firms relocated their operations to less restrictive jurisdictions. The new regulations could lead to a mass migration of crypto companies outside the EU to avoid costly and time-consuming processes associated with the new regulations.

Opportunities and Challenges in the Era of MiCA

The introduction of MiCA is a step towards greater transparency and security in the cryptocurrency market but also brings numerous challenges for forex companies and technology providers. In the face of these changes, it will be crucial to find trusted partners who not only understand the new regulations but can also provide reliable solutions that support the operational stability of the business.

As a leading technology provider, we have ensured that our crypto payment processor, Match2Pay, is meticulously prepared for the upcoming changes. Thanks to an extensive infrastructure and years of experience in the forex industry, we offer comprehensive support for brokers who value transparency and security while maintaining high-quality services.

(TRC20)

(TRC20) (BEP20)

(BEP20)