Powerful improvements have just arrived at Match2Pay, directly addressing the reported security challenges and workflow bottlenecks. Through ongoing conversations with users, we identified key opportunities to transform risk management, payment handling, and compliance navigation. The platform now features an intelligent system for verifying crypto withdrawals with contextual risk assessment, direct bank withdrawal functionality, self-service compliance rejection management, and flexible post-payment navigation options. These thoughtfully designed enhancements strengthen security protocols while simplifying daily operations – all within the familiar Match2Pay interface.

Additional Confirmation Conditions

We’ve introduced a smart, real-time crypto withdrawal guardian that assesses withdrawal risk based on context and behavioral patterns rather than static amount or count limits. This advanced engine analyzes multiple signals, including unusual weekend/after-hours activity, rapid transfers to identical wallets or amounts, new-wallet thresholds, percentile deviations from client history, an unusually large share of the balance, and first-in-X-days patterns. When risk is detected, the request is automatically routed into an extra confirmation flow with a clear lifecycle (NEW → ADMIN CONFIRMATION → DONE), real-time status, and full transparency on which rule fired, who acted, and when.

Through an integrated dashboard, authorized users can quickly review and confirm requests in the Admin confirmation status, maintaining strong security without causing client delays. All verification actions require two-factor authentication (2FA) and create comprehensive audit records. The dashboard comes with preconfigured security rules that merchants can activate instantly. Custom conditions can be implemented upon request without any code changes.

Benefits:

- Risk and operations teams gain stronger protection with fewer false positives via context-aware routing, faster approvals with transparent statuses, and predictable escalations when anomalies occur.

- Tailored control allows merchants to configure virtually any condition and escalation policy per broker, with thresholds and time windows adjustable without code modifications and unified reporting across flows.

- Organizations achieve enterprise-grade governance with least-privilege access, separation of duties, 2FA and whitelisting, full audit trails, and compliance-ready oversight.

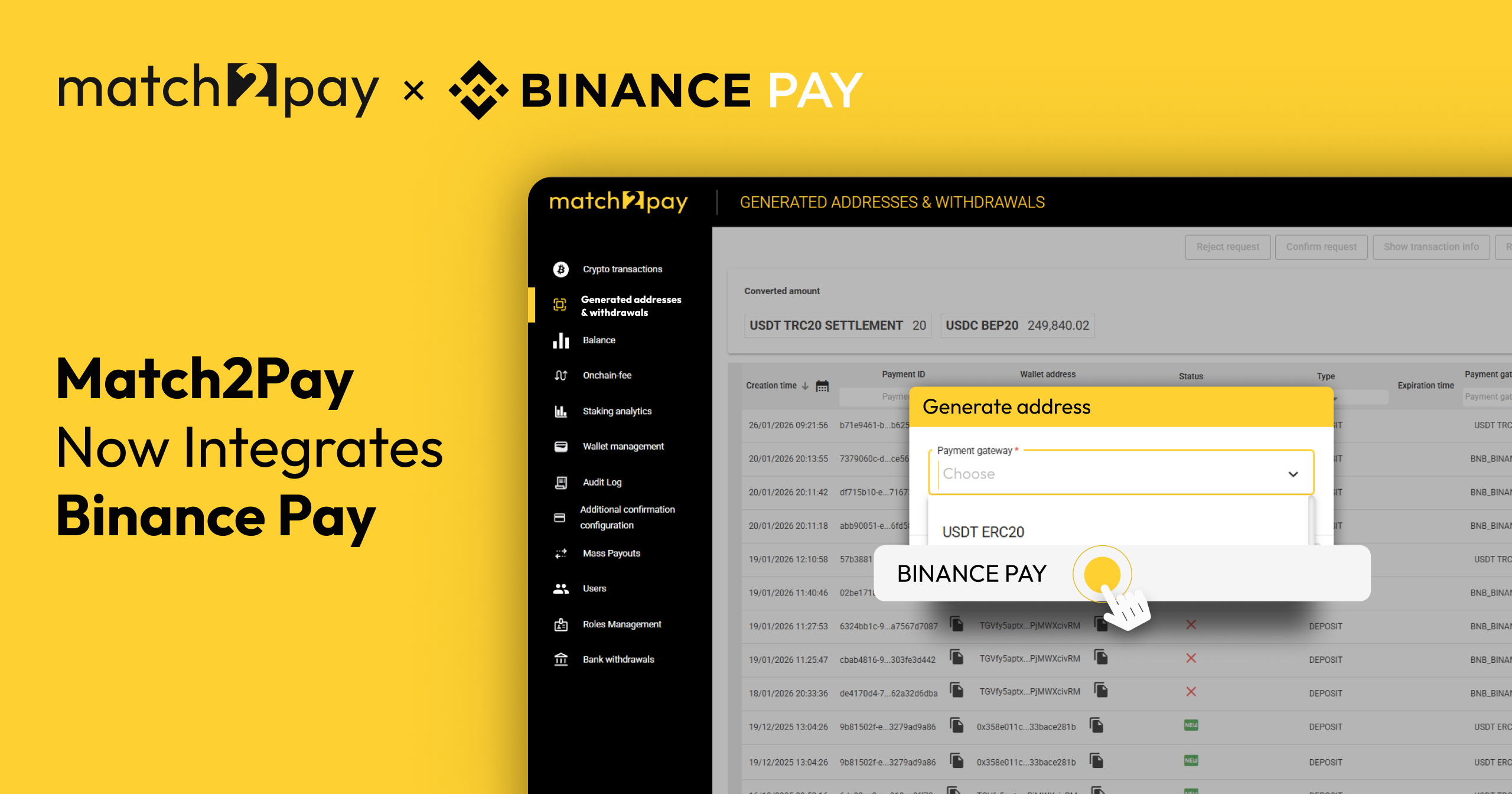

Bank Withdrawals

Following our recent Equals cooperation, direct bank withdrawals from Match2Pay accounts are available. This enables you to accept crypto payments with direct fiat settlements to your business bank account, eliminating operational complexity. Match2Pay now fully supports the crypto-to-fiat market, making it perfect for companies wanting to offer cryptocurrency options at checkout while operating with traditional currencies.

Users can create and maintain a bank account whitelist as in conventional banking systems for simplified future withdrawals. After whitelisting a bank account, you can withdraw selected amounts directly from your merchant balance to the saved account, delivering a consistent, secure, and efficient process.

Benefits:

- Merchants gain payment flexibility with the ability to accommodate client crypto preferences while keeping payouts in currencies that align with their business operations.

- Teams benefit from streamlined workflows that eliminate manual conversion requirements and reduce reconciliation complexity.

- Companies achieve technological cohesion through Match2Pay’s platform, which handles cryptocurrency processing and delivers seamless bank withdrawals for fiat settlements.

Reversals of Legally Rejected Deposits from the Dashboard

Merchants can now reverse deposits rejected by the Compliance Team directly within the platform. Previously, clients needed to wait for an email from the legal team explaining rejection reasons and offering either reversal options or requesting additional documentation for further review.

The new system allows clients to initiate reversals directly through their dashboard. This improvement particularly benefits users during non-business hours when response times typically lengthen and funds would otherwise remain frozen.

Benefits:

- Rejected deposits appear in a dedicated “Compliance Rejections” section under Crypto Transactions tab for quick and efficient handling.

- Merchants with “Compliance Rejection” permissions can instantly return funds to a selected wallet address regardless of business hours.

- Clients no longer depend on manual intervention for transaction resolution, reducing wait times.

- Merchants retain the option to upload additional documents for the legal team to review, potentially leading to deposit approval.

Redirect from the Payment Page After Successful Payment

For merchants integrating external CRM systems with the Match2Pay payment page, we now support custom post-transaction redirects. After completing a successful deposit, clients can be automatically redirected to any merchant-specified URL. This enables seamless returns to the Client Office, custom thank-you pages, or other relevant destinations.

Benefits:

- User experience is enhanced when clients transition easily to a relevant page after completing their payment.

- Merchants can redirect clients to custom pages, such as a dashboard, an information page, or a promotional offer, after transaction completion.

- The workflow for businesses using external CRM systems is streamlined, as customers move through a more integrated journey.

(TRC20)

(TRC20) (BEP20)

(BEP20)