The MENA region is experiencing an acceleration in digital adoption, which presents an opportunity for Forex Brokers to leverage the growing trend towards digital transactions. The rapidly evolving landscape of financial technology and the increasing integration of cryptocurrencies into traditional financial services have led to a surge in demand for FX Brokers that accept crypto payments.

However, in the Middle East and North Africa region, where the regulatory environment for cryptocurrencies varies widely, choosing the right jurisdiction to operate is crucial for the success. Here, we delve into the MENA jurisdictions that offer a promising environment for Forex brokerages with a keen interest in accepting cryptocurrency payments and uncover the pitfalls and restrictions that Brokers may encounter.

UAE

The UAE has emerged as a global crypto hub, backed by comprehensive regulations and progressive initiatives. Both Dubai and Abu Dhabi boast a robust regulatory framework, with the Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM) leading the charge. The issuance of guidance on the regulation of virtual asset activities and the establishment of the Virtual Assets Regulatory Authority (VARA) in Dubai highlight the commitment to fostering a crypto-friendly ecosystem.

While the current regulatory landscape does not permit Forex Brokers to accept crypto payments, the UAE has offered a favourable regulatory environment for digital assets companies and granted licences for many global exchanges. This has seen both Dubai and Abu Dhabi emerge as global crypto hubs. Brokers eyeing crypto payments adoption in the near future should consider the UAE’s potential.

Saudi Arabia

Saudi Arabia presents a unique scenario in the MENA region. Despite the government’s prohibition of cryptocurrencies and a ban on banks processing crypto transactions, the popularity of digital assets among citizens is on the rise.

For Forex Brokers, the option to accept crypto payments in Saudi Arabia comes with risks. But the lack of clear penalties for engaging in crypto trading, coupled with a growing interest in digital currencies, makes it a market worth monitoring. The country allows a limited number of cryptocurrency exchanges to operate, though major platforms like Coinbase and Binance await regulatory permission.

Bahrain

Bahrain positions itself as a pioneer in the region by establishing clear regulations for crypto assets. The Central Bank of Bahrain (CBB) issued regulatory rules covering licensing requirements, minimum capital standards, cybersecurity measures, and more. The creation of the region’s first onshore regulatory sandbox further underscores Bahrain’s commitment to fostering innovation in blockchain applications.

However, as it stands, Forex Brokers in Bahrain cannot accept crypto payments. The regulatory framework, while robust, currently does not extend to this aspect of financial transactions.

Kuwait

Kuwait takes a cautious approach to cryptocurrencies, with the Ministry of Finance not recognizing them for official commercial transactions. The Central Bank of Kuwait (CBK) prohibits trading in cryptocurrencies and their acceptance in e-payment transactions. Despite these restrictions, the government has not explicitly banned citizens from using cryptocurrencies, leaving room for individual engagement.

For Forex Brokers, accepting crypto payments in Kuwait is possible, but poses a risk due to the absence of regulatory support. The government’s focus on creating an infrastructure for a local digital currency further emphasises a conservative stance toward existing cryptocurrencies.

Jordan

Jordan takes a firm stance against digital currencies, with the Central Bank prohibiting banks, currency exchanges, financial companies, and payment service providers from dealing in them. While not recognized as legal tender, small businesses and merchants may still accept digital currency payments.

Regulatory landscape in MENA will change in the near future

The current regulatory landscape in the Middle East is undergoing changes that could create a more favourable environment for Brokers and other companies interested in accepting crypto payments. Governments in the region, particularly exemplified by Saudi Arabia’s target for 70 percent digital payments by 2030, showcase a commitment to ambitious digitization goals. Such goals indicate a regulatory environment that is supportive of advancements in payment technologies. The implementation of open banking and the focus on cross-border transactions signal a regulatory environment that is increasingly friendly to innovations in the payments sector, including the acceptance of crypto. However, as with any regulatory changes, the specifics of the regulatory frameworks in individual countries should be closely monitored for a comprehensive understanding of the regulatory environment for crypto payments acceptance

Offshore alternatives for Brokers in the MENA region

Seychelles

Seychelles has solidified its status as a jurisdiction fostering a favourable regulatory environment for financial services, including Forex businesses. The FSA provides a flexible framework, facilitating a more straightforward and cost-effective licensing process for Forex activities. Forex Brokers in Seychelles enjoy significant tax benefits, with quite low tax levels depending on the structure.

Under FSA oversight, FX-Brokers in Seychelles adhere to strict regulations ensuring investor protection. This includes fund segregation, capital maintenance, and robust risk management practices. Notably, there are no restrictions on leverage for companies operating in Seychelles, providing flexibility to Forex brokerages. Brokers based in Seychelles can use crypto payments after meeting local conditions regarding securing client funds in FIAT.

Mauritius

Forex Brokers operating in Mauritius fall under the oversight of the Financial Services Commission (FSC), the government’s regulatory body for the non-banking financial sector. In comparison to regulatory standards in Europe and the United States, the FSC typically adopts a more lenient stance on Forex broker regulations. It is common for Forex Brokers in Mauritius to offer high trading leverage as a standard practice.

Cryptoassets are officially recognized and permissible in Mauritius. Effective February 7, 2022, a significant portion of these assets is now subject to regulation overseen by the Financial Services Commission of Mauritius. Following this regulatory development, brokers from Mauritius can use crypto payments without encountering any obstacles.

How to accept crypto payments in the MENA region?

As cryptocurrency gains traction in the MENA region, the recent introduction of regulations for crypto exchanges signifies a pivotal moment. It’s only a matter of time before regulatory authorities, having tested the waters with exchanges, extend their approval for Brokers to collect funds in crypto. Currently, this avenue is already open through jurisdictions like Seychelles and Mauritius.

The MENA region’s evolving stance on cryptocurrencies requires a strategic approach for Forex brokerages seeking to thrive in this dynamic landscape. The evolving situation with the regulatory environment suggests a positive trajectory for Forex Brokers looking to embrace crypto payments. It’s anticipated that as regulations mature, Brokers will soon gain approval to accept funds in cryptocurrency. Notably, Seychelles and Mauritius are at the forefront, providing opportunities for Brokers to explore this payment method.

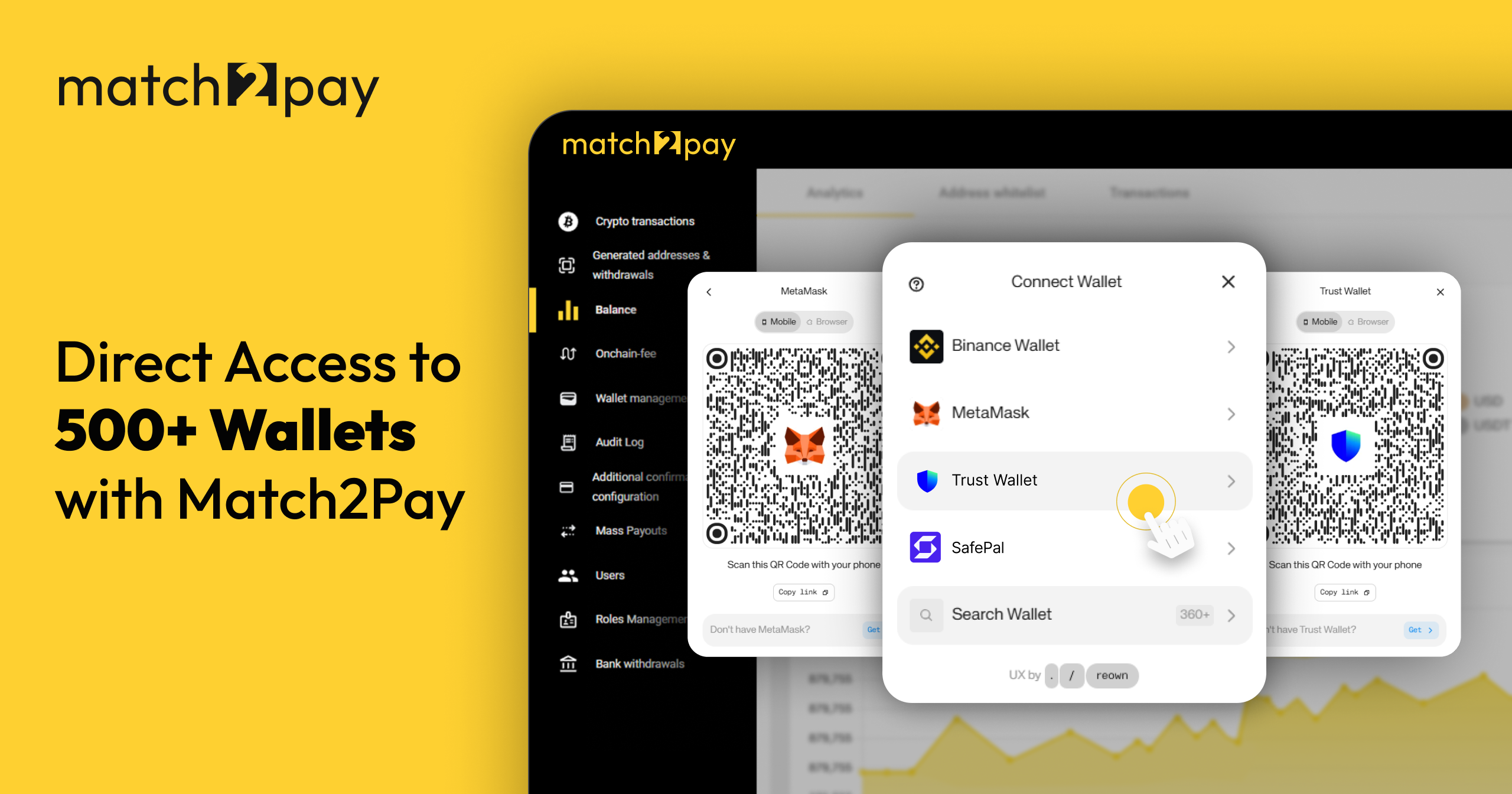

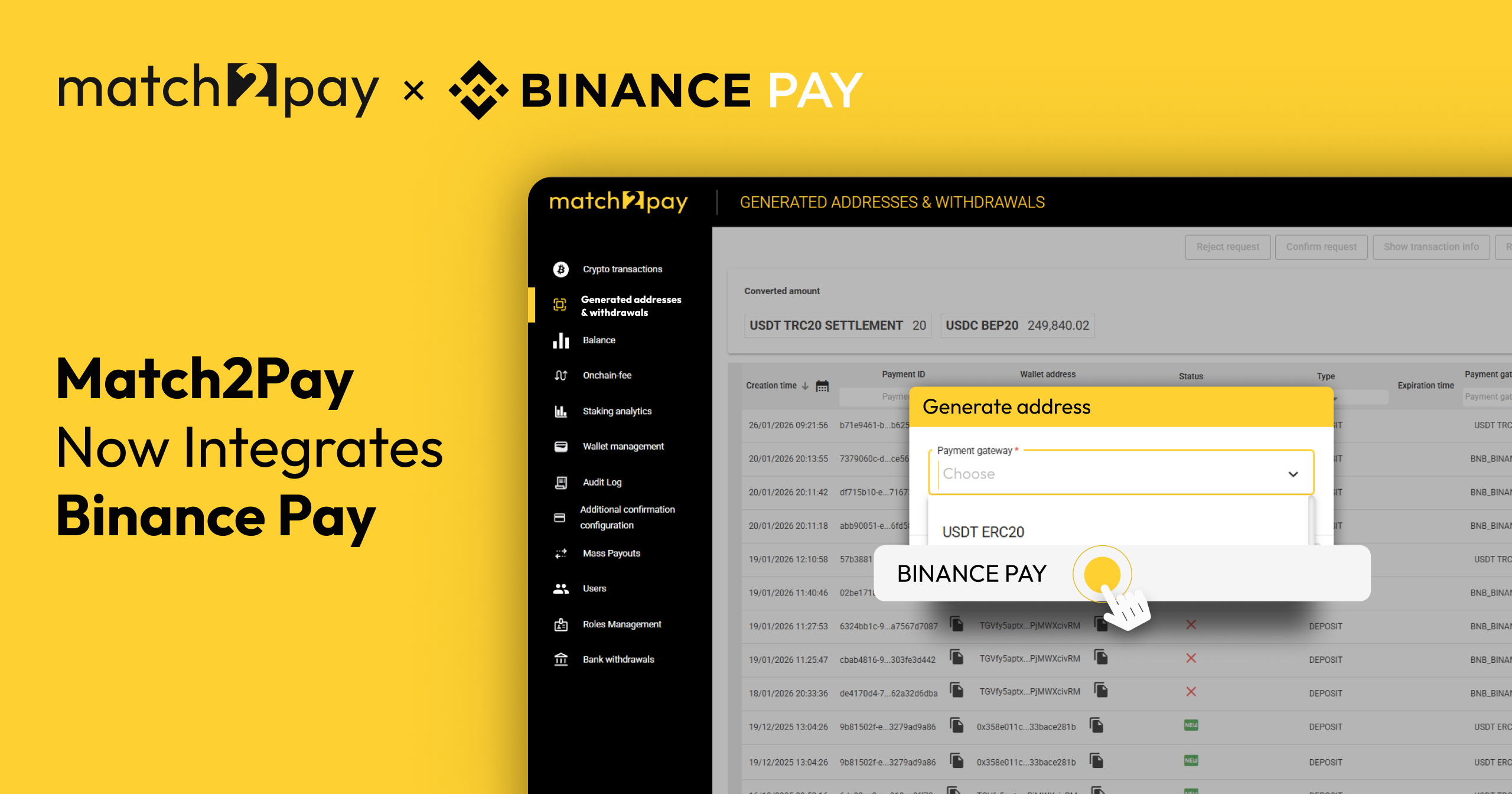

The key to accepting crypto payments in the MENA region lies in staying informed about evolving regulations. Contact us today to discover why Match2Pay is the strategic partner you need to thrive in this dynamic and lucrative landscape. With our expertise, your brokerage is is well-prepared, compliant, and ready to seize opportunities in this era of crypto-integrated financial services.

Match-Trade Technologies, the provider of our cutting-edge technology for crypto payment processing, has recently established a representative office in Dubai. We’re here to address any questions or concerns you may have and eagerly await the chance to meet with you.

(TRC20)

(TRC20) (BEP20)

(BEP20)