The payment system in Africa is transforming at an unprecedented speed, fueled by tech breakthroughs, regulatory shifts and demand for cross-border money transfers. A recent panel discussion at FMAS:25 brought together industry leaders to explore the barriers and opportunities shaping the continent’s financial future, with insights from the emerging crypto payment sector.

Regulatory Fragmentation: Africa’s Greatest Challenge

Africa’s financial integration faces a formidable obstacle: regulatory fragmentation across 54 distinct jurisdictions. Each country maintains its legal framework, creating substantial complexity for financial service providers seeking to scale operations across borders. Yet the challenge extends far beyond basic regulatory differences.

A financial service operating successfully under one nation’s regulatory framework often discovers entirely incompatible requirements when expanding to neighbouring countries. This fragmentation forces organisations to navigate multiple regulatory environments simultaneously. Each jurisdiction demands separate licensing procedures, imposes unique operational restrictions and enforces distinct compliance obligations. The cumulative effect creates significant barriers to continent-wide expansion and seamless payment integration.

Central banks across the continent acknowledge these issues and are working together on various initiatives to establish more unified standards.

Transforming Traditional Banking with Cryptocurrency

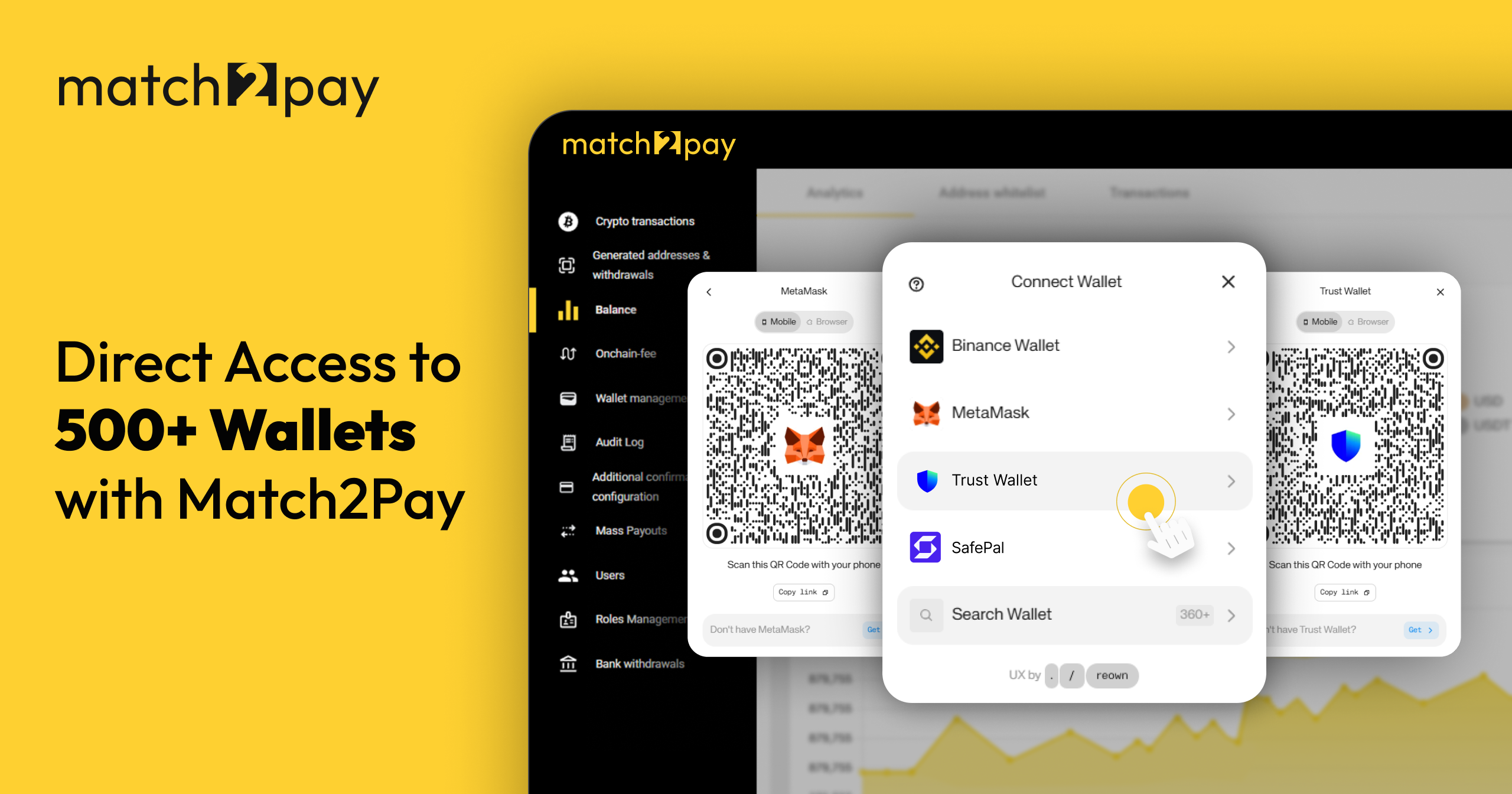

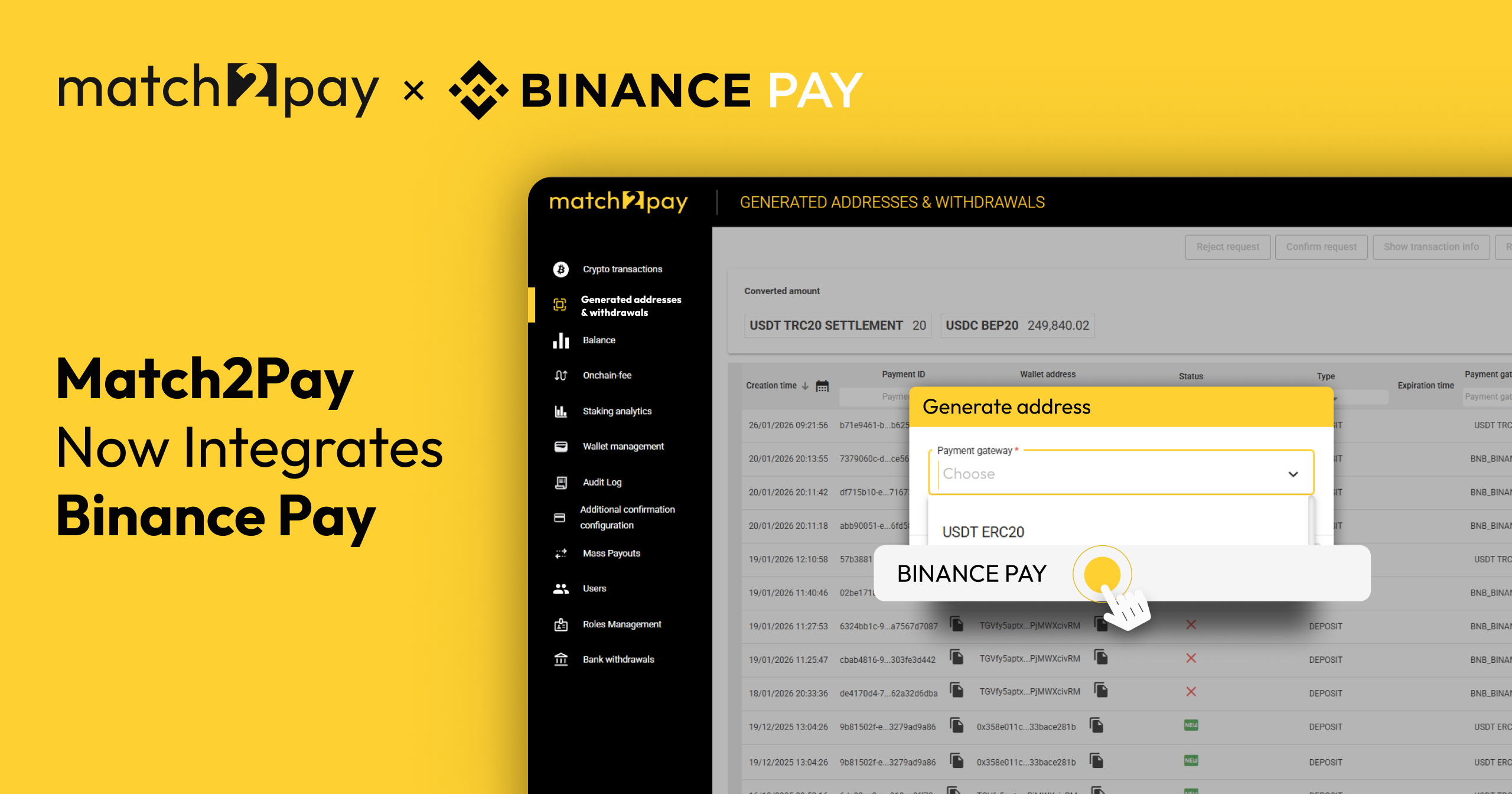

The relationship between cryptocurrency and traditional banking systems has experienced radical change. Cryptocurrency, once perceived as banking’s biggest rival, now enables instantaneous global transfers for businesses ranging from Forex brokers to gaming companies and prop trading firms.

The shift has been nothing short of extraordinary. Back in 2018, banks were working hard to oppose the crypto industry. “Initially, it was seen as a challenge, a threat. We had banks lobbying very hard against the crypto industry in general. They wanted to shut it down because crypto was doing something that the banks were not able to do—it was saving time, settling immediately, and much cheaper,” says Andrey Kalashnikov, Head of Match2Pay.

Now, industry insiders see traditional banks heading toward integration rather than elimination. The reason is simple: blockchain’s universal infrastructure—it’s accessible in every country and can be deployed anywhere, including Africa.

Infrastructure and Interoperability Gaps

Mobile money platforms exemplify another challenge perfectly. Despite achieving remarkable adoption rates across the continent, these systems remain trapped within national boundaries. Take Uganda and Kenya, for example. Both countries have modern mobile ecosystems, but somehow your cash can’t make that journey. This barrier strangles cross-border trade, at the same time blocking economic growth.

Market diversity also adds a layer of complexity. South Africans gravitate toward card payments, Kenyans have embraced mobile money and Nigerians still rely heavily on cash transactions. Successful payment solutions must accommodate these regional preferences while delivering smooth cross-border functionality.

Building truly integrated African payment systems demands both technical interoperability and cultural adaptability—a combination that requires coordinated industry effort.

Digital Identity and Compliance Evolution

Digital identity infrastructure stands as a critical foundation for seamless cross-border transactions, yet implementation remains frustratingly inconsistent across Africa. Some countries have deployed comprehensive digital KYC systems, while others announce ambitious financial identity initiatives that have to materialise. This patchwork approach prevents the universal solutions necessary for true payment integration.

The compliance landscape has matured considerably, particularly within cryptocurrency markets. Robust frameworks now effectively address money laundering risks, sanctions compliance and transaction transparency requirements. “We have the compliance now,” explains the Head of Match2Pay. “We’re less worried about drug trafficking or sanctioned transactions. We have KYT (Know Your Transaction), we know who’s sending and we have the travel rule information. The transactions now have that compliance.”

Despite these advances, the absence of standardised digital identity systems across borders continues generating significant friction. Individual countries may achieve internal progress, but cross-border transactions still require separate compliance processes in multiple jurisdictions due to incompatible identity verification systems.

Looking Ahead: The Five-Year Goals

Panel experts have set an ambitious five-year vision for Africa—complete payment transformation. Their plan envisions instant cross-border transactions, universal financial inclusion and seamless currency conversion from country to country. But as Andrey Kalashnikov notes, this strategy should extend beyond just payments. “If I come back to Africa in five years, I would expect the whole continent to have grown GDP-wise, because when you have GDP growth, everything increases—education, financial literacy, internet access”, he concludes.

Want to hear more from top industry experts? Watch the full panel session.

(TRC20)

(TRC20) (BEP20)

(BEP20)