The crypto payments landscape is evolving rapidly. Recently, we’ve seen growing interest from many merchants in moving from crypto-only operations to FIAT settlements. This shift introduces significant cost challenges that most payment processors still struggle to address effectively.

Scalable On-Ramp & Off-Ramp Options Available

A growing number of crypto payment providers are entering the market, promising seamless FIAT settlements for their clients. In reality, many of these solutions depend on fragile banking relationships that, as volumes scale, put additional strain on banks and can lead to account closures or partial fund freezes. Before enabling FIAT settlements for Match2Pay merchants, we needed to be sure the solution would be stable and, above all, scalable. Thanks to our experience and operational scale, we’re now able to present a solution we’re genuinely proud of.

Flexibility Is the Key

At Match2Pay, we designed our platform to give merchants maximum flexibility in configuring crypto processor rules. Incoming crypto can be auto-converted to stablecoins, FIAT, or even other assets such as BTC. Alternatively, accepted crypto funds can be held in the original currency and converted on demand – whenever the merchant needs – to FIAT or other crypto. The same flexibility extends to the on-ramp, with support for deposits in multiple FIAT currencies, including USD and EUR. Match2Pay also maintains accounts with leading electronic money institutions (EMIs), enabling instant in/out transfers for added speed and convenience.

True 1:1 Conversion with Match2Pay

The traditional payment processing business model depends on opacity. Processors advertise competitive transaction fees while profiting through hidden conversion markups, typically discovered only after implementation. This approach works because merchants have limited alternatives and conversion rates get treated as technical details rather than fundamental costs.

Match2Pay has built a fundamentally different business model from first principles. Instead of profiting from hidden conversion spreads, we generate value through operational efficiency and proprietary technology that eliminate intermediary costs.

Our FIAT settlement delivers transparent economics:

- True 1:1 conversion at fixed rates with zero hidden spreads

- Direct bank settlement to existing merchant accounts through established rails like Equals and other reputable EMIs

- Unified compliance process leveraging pre-established banking relationships

- Same-day processing within compatible banking ecosystems

This stands as more than competitive pricing – it represents a completely different value proposition. Our control of the entire proprietary technology stack enables quick adaptation to evolving compliance requirements, new settlement currencies, or integration demands without vendor delays or third-party limitations.

M2P Built for Hybrid Finance

Our transparent settlement infrastructure supports our current clients across FX, prop trading, and iGaming while positioning Match2Pay for the broader evolution toward hybrid finance: cross-border e-commerce requiring efficient international settlement, remittance services combining crypto rails with local FIAT delivery, and fintech applications where crypto efficiency meets traditional banking accessibility.

Match2Pay is more than a payment processor – we’re building financial infrastructure that grows with businesses long term. While competitors’ hidden spreads deteriorate economics as merchants scale, our transparent 1:1 rate means economics strengthen with volume. Our success aligns with merchant success: we generate value through operational efficiency and genuine partnership, not by marking up their money.

This foundation lets merchants focus on scaling their core business instead of managing an increasingly complex ecosystem of financial service providers – a payment gateway that enhances rather than extracts from your company’s potential.

Want to learn more about Match2Pay’s other advantages?

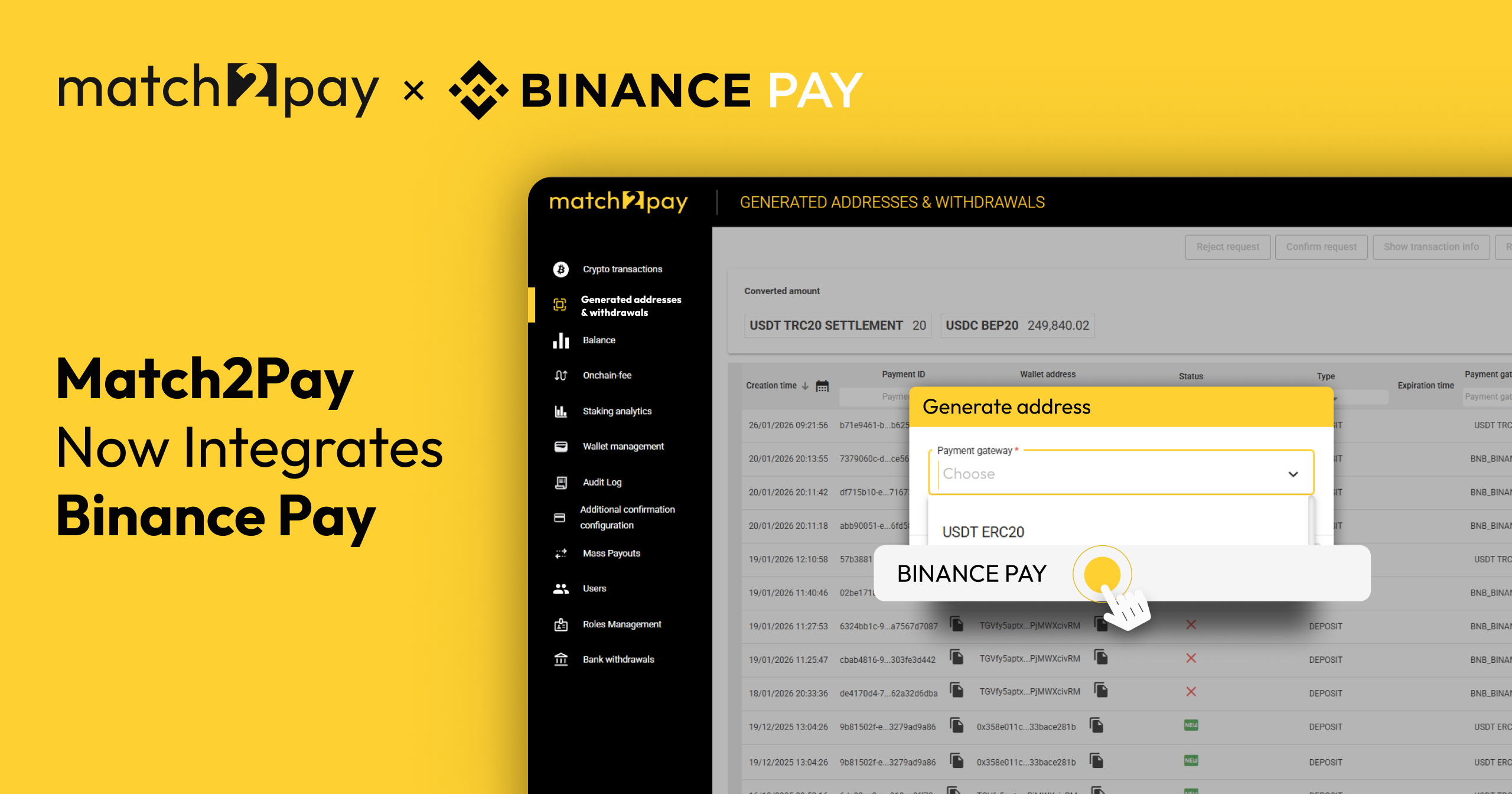

(TRC20)

(TRC20) (BEP20)

(BEP20)