If you’ve ever sent cryptocurrency or used a decentralised app (dApp), you’ve encountered gas fees firsthand. These “minor” charges may seem insignificant individually, but they have a habit of quickly compounding—often without warning. The hard truth is that most users are overpaying simply because they don’t understand the mechanics. Yet mastering gas fee fundamentals takes far less time and effort than you’d expect.

What Are Gas Fees and Why Do They Matter?

Consider gas fees to be the cost of doing business on a blockchain. Similar to filling up your car, submitting a transaction on networks like Ethereum or Solana necessitates paying gas fees. Every time you buy tokens or swap cryptocurrencies, your request is handled by numerous validators who are compensated for their work.

But gas fees also serve another essential function: they help prevent spam. Without them, harmful users might flood the network with worthless transactions. By requiring payment for each operation, blockchains ensure their security and effectiveness.

How Gas Fees Impact Transaction Costs

Gas fees aren’t fixed. They constantly rise and fall based on network demand. During peaks, gas prices can surge as users compete to get their transactions processed as soon as possible.

The complexity of your transaction also matters. Transferring basic tokens between wallets requires little computation and costs much less. However, more processing power is needed, driving up expenses, when initiating smart contracts or running complex decentralised finance (DeFi) operations.

Transaction speed plays a role too. Most wallets let you choose between different fee levels: economy, standard and fast, the difference between which can be substantial. An economy transaction might cost $1, whereas a fast transaction could run as high as $50 for the same operation.

Smart Methods for Reducing Gas Fees

You don’t have to accept high gas fees as inevitable—there are proven strategies that can minimise your transaction costs:

- Time your transactions strategically. Gas fees follow predictable patterns. They tend to drop during weekends, late nights (1–6 AM UTC) and major holidays when most people aren’t actively transacting. By scheduling your blockchain interactions for quieter periods, it’s possible to reduce fees by 50% or more.

- Monitor using gas tracking tools. With tools like Etherscan Gas Tracker, DeBank and Coinrule, you can identify optimal transaction windows and skip the high-fee hours. It’s also worth setting up alerts that notify you when prices drop or fees hit your target range.

- Adjust your wallet settings. Many wallets default to higher gas prices than necessary. By customising your max fee and priority fee settings, you can avoid overpaying during low-demand periods.

- Use alternative networks. Alternative blockchain networks such as BEP20 (Binance Smart Chain) are much easier on your wallet. Layer 2 solutions, built on top of existing blockchain networks, or other networks with lower fees offer viable options for cutting down on transaction costs.

Batching and Gasless Solutions for High-Frequency Payments

High-frequency payments involve rapid, repeated processing of numerous small-value transactions within short timeframes—unlike traditional sporadic or high-value transfers. These continuous, automated fund transfers enable power users and businesses to achieve significant cost reductions through advanced optimisation strategies.

Transaction Batching

Transaction batching works by combining multiple operations into one blockchain transaction. Rather than paying base gas fees over and over again, you pay just once and spread that cost across all the operations you’ve included. This markedly cuts down total gas expenses—you can typically lower gas usage by 30–70%, depending on how many operations you batch and how complex they are. Batching is particularly effective for token transfers, contract interactions and other actions you do repeatedly.

Gasless Solutions

With gasless solutions, users can transact on blockchain networks without handling gas fees. A third-party service or relayer steps in to pay these transaction costs, typically leveraging meta-transactions and standards like EIP-2771. This setup eliminates the need for users to hold native tokens for gas, which can reduce user friction by up to 80%. The result is that small payments become practical again, and blockchain interactions feel much more straightforward and accessible.

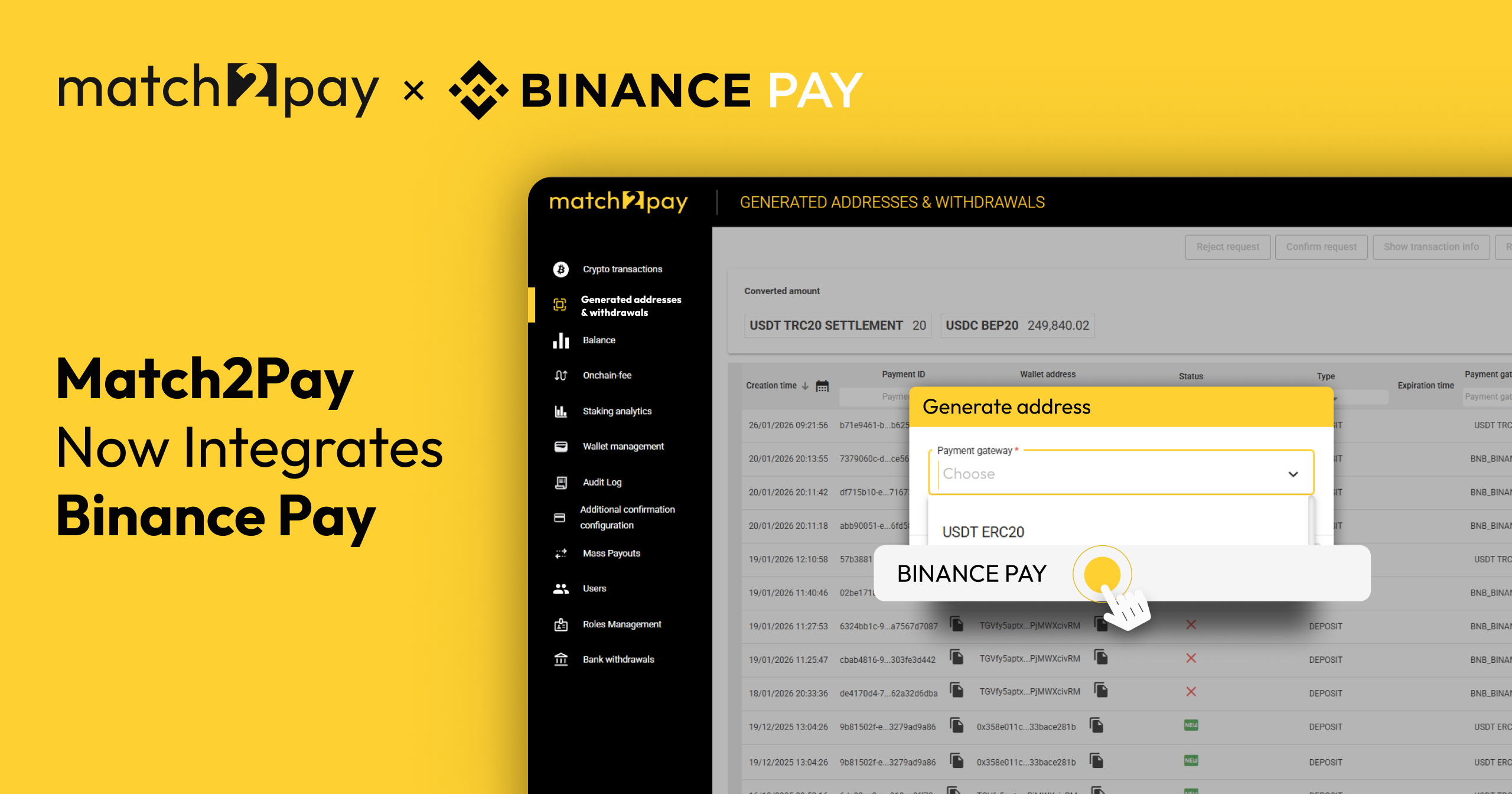

Stop Overpaying with Match2Pay

At Match2Pay, we’ve implemented a fixed gas fee model designed to bring clarity, efficiency and cost savings to your operations. Instead of exposing your business to unpredictable blockchain network fees, our system constantly analyses network conditions across supported chains to determine the optimal fee level, balancing speed and cost. This ensures your transactions are processed quickly without the burden of overpaying for gas. By managing the complexity behind the scenes, we simplify the crypto payment experience for you.

This approach also brings major benefits to your finance and operations teams. With fixed fees, your cost calculations become predictable, allowing for accurate budgeting, margin planning and transparent reporting. You no longer need to account for fluctuating on-chain costs or delays due to underfunded transactions. At Match2Pay, we know the tricks of the trade—and we use that knowledge to help your business scale smoothly and sustainably in the crypto space.

Want to learn more about Match2Pay’s other powerful features? Contact our team!

(TRC20)

(TRC20) (BEP20)

(BEP20)