Brokers that accept crypto often encounter fluctuating transaction fees that can significantly impact the cost of processing crypto payments. This phenomenon can be confusing, particularly when fees seem to spike unexpectedly. To clear up the confusion, it’s important to distinguish between network (onchain) fees and crypto processing fees, and understand why these fees sometimes increase dramatically.

What are Network / Onchain Fees?

Network fees are essential charges paid to miners or validators for processing and confirming transactions on a blockchain. Every time you initiate a cryptocurrency transfer, the transaction data needs to be recorded on the blockchain. Miners perform this task, and network fees are their compensation.

Why Do Network Fees Fluctuate and Seem to Skyrocket?

Network fees fluctuate primarily due to changes in network load and asset prices. When a blockchain network experiences heavy usage, such as during a market surge, the increased demand for transaction processing drives up fees. Users willing to pay higher fees get their transactions confirmed faster, contributing to overall fee increases.

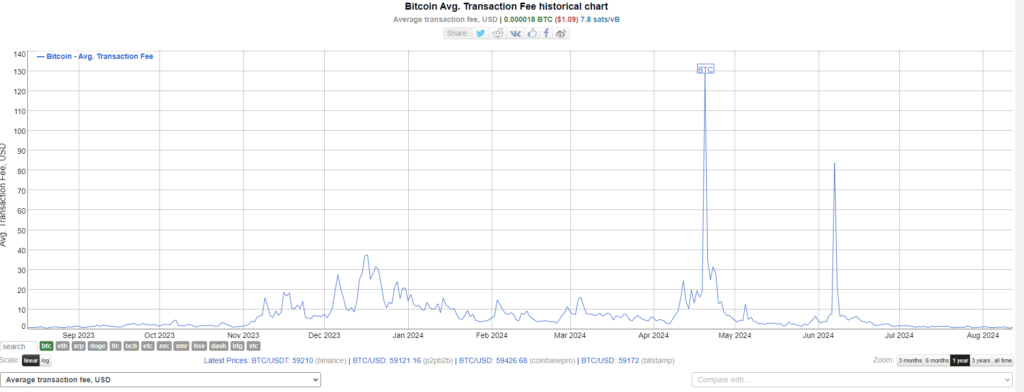

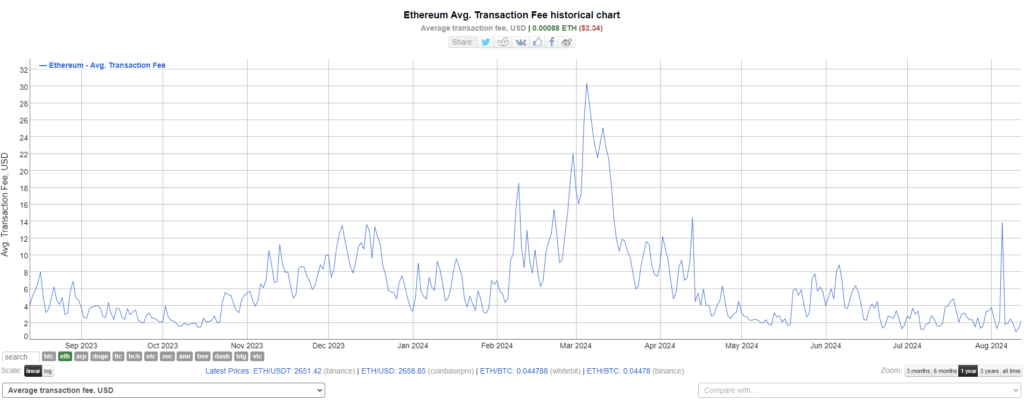

For example, Ethereum’s network fees, also known as gas fees, can vary widely. During periods of low activity, average fees might be relatively modest. However, in a bull market, these fees can spike significantly as demand for transaction processing soars. Similarly, Bitcoin transactions are subject to varying fees based on network congestion and transaction size.

At times, users might notice sudden increases in fees, especially during high market activity. This can be attributed to a combination of rising network fees due to congestion and the exchange’s operational adjustments to cope with increased demand.

It’s important to recognize that while exchanges set their commission fees, they cannot control network fees. When blockchain networks become congested, transaction fees rise independently of the exchange’s policies. This is why, during periods of high interest in cryptocurrencies, users might experience a significant rise in overall transaction costs.

How Onсhain Transaction Fees are Calculated

When processing crypto, understanding what influences your transaction fees is vital for managing operational costs of your brokerage business. While we strive to keep fees as low as possible, certain external factors, such as network congestion and market demand, can affect the final cost. Although these elements are beyond the control of your payment provider, they are critical for ensuring the timely and secure processing of transactions.

For example, Bitcoin transaction fees are determined primarily by the size of the transaction in bytes and the current demand on the network. When more users are transacting, fees can increase significantly, sometimes reaching $20 or more during peak times. These fees are paid to miners who validate and include transactions in the blockchain. A typical Bitcoin transaction might cost anywhere from $1 to $10, depending on network congestion and transaction size. With a block time of approximately 10 minutes, users often pay higher fees to prioritise their transactions. However, even with higher fees, transactions cannot be processed faster than the 10-minute block time.

Ethereum’s fee structure is more complex due to its gas system. Each transaction requires a certain amount of gas, and users set a gas price in gwei (1 gwei = 0.000000001 ETH). The introduction of the EIP-1559 upgrade in August 2021 brought a new mechanism, where a base fee is burned and a priority fee (or tip) is given to miners. This change aims to make fees more predictable, though they can still vary widely. As of mid-2024, simple transactions on Ethereum typically cost between $0.50 and $5, with more complex operations costing more. Ethereum’s faster block time of 12-14 seconds does help in faster transaction inclusion compared to Bitcoin.

Match2Pay crypto processor makes your business transactions straightforward with a clear fee structure regarding the package:

- Setup fee: A one-time payment only for new integrations, with many ready-made options already available for immediate use.

- Processing fees: Based on a percentage of transactions (including onchain fees), though a minimum fee may apply depending on the blockchain.

- Minimum Monthly Fee: Free of charge.

- Settlement Fees: Free of charge for settlements in both crypto and stablecoins.

This transparent approach ensures you have a comprehensive understanding of all costs, simplifying expense management and supporting effective financial planning.

By leveraging our technology developed in-house by Match-Trade Technologies, we can offer a highly competitive software tailored to your business needs. This is an advanced solution for your business where you can take on the onchain fees yourself and even offer crypto payments to the third parties under white label. Our pricing for Match2Pay Pro includes:

- Processing Fees: Lower than the standard version but do not include onchain fees.

- Minimum Monthly Fee: 3000 USD.

- Onchain Fees: Paid by the merchant.

This structured approach allows us to provide a clear understanding of the costs involved, helping you manage your operational expenses more effectively. By breaking down these components, we ensure that our clients have a transparent view of the fees associated with our services, facilitating better financial planning and operational efficiency.

Alternative Networks with Lower Fees

High transaction fees on Bitcoin and Ethereum have led to the development and adoption of alternative networks, significantly reducing the costs, while still allowing to transfer most popular stablecoins.

Other blockchain networks Match2Pay supports also offer lower fees:

- Binance Smart Chain (BSC): A fee structure similar to Ethereum with a gas fee for each transaction, but significantly lower compared to ETH average fee.

- Solana (SOL): Provides some of the lowest fees on the market.

- Polygon (MATIC): Utilises Ethereum’s security while maintaining low fees.

- Tron (TRX): Offers fast transaction speeds, one of the most cost-effective networks for micropayments and decentralised apps.

These networks also allow for setting lower “minimum fees per transaction”. Contact our team at contact@match2pay.com to learn more.

These alternatives provide viable options for users seeking to minimise transaction costs while still benefiting from the security and decentralisation of blockchain technology. At Match2Pay, we support a wide array of alternative networks, allowing us to offer the best market conditions with the lowest fees. Despite the general increase in market fees, we remain committed to providing our users with competitive and favourable transaction terms.

For more detailed information, please contact our team.

(TRC20)

(TRC20) (BEP20)

(BEP20)