If you’re holding USDT, Bitcoin, or other cryptocurrencies in Asia, you’re part of something big. Japan has 12 million cryptocurrency exchange accounts, roughly one for every ten people, while Indonesia’s crypto industry is working with regulators to create a rupiah-backed stablecoin for the country’s US$20 billion annual remittance market. Within the same hotbed that is Southeast Asia, Vietnam has recently held a major government seminar on using blockchain to improve cross-border payments. At the same time, Thailand just launched a Government-backed program in August, allowing tourists to convert crypto to baht for everyday spending.

This isn’t early adoption anymore. It’s mainstream financial infrastructure.

But here’s the gap: whilst it’s remarkably easy to send crypto to friends or make purchases, using those same funds to access financial services like trading has been surprisingly difficult. You might have US$10,000 in USDT sitting in your wallet – capital that could be working for you in the markets – but first you’d face multi-day bank conversions, multiple fees, and delays that stretch across weekends.

That disconnect has frustrated traders across the region. The infrastructure for holding and transferring crypto matured rapidly. But what about the infrastructure for deploying it into trading platforms? Until recently, it simply didn’t exist.

The Last-Mile Problem

Across Asia, millions of people hold cryptocurrency not as speculation, but as working capital. Families receive remittances in stablecoins, saving huge amounts on the high transaction fees traditional channels charge. Businesses accept crypto payments to serve international clients efficiently. People in markets with currency volatility hold USDT as a USD hedge.

But when someone wants to deploy that capital into trading (to hedge currency risk, trade commodities, or access forex markets), they hit a wall. The speed and efficiency of crypto payments disappear, replaced by the same slow banking processes crypto was supposed to solve.

Why Asia Needs This More

Currency Volatility: Unlike markets where local currencies stay stable, many Asian countries experience significant volatility. When the Philippine peso or Indonesian rupiah faces pressure, households could turn to stablecoins not for speculation, but as a pragmatic hedge against currency risks. That capital deserves efficient deployment options.

Remittance Flows: Millions of families receive regular income in cryptocurrency, forming backbones for household budgets and working money. When recipients want to use some of it for trading or investment, they too need infrastructure that works naturally.

Mobile-First Populations: With smartphone penetration exceeding 80% in many Southeast Asian markets, crypto wallets have become primary financial interfaces for millions of people. Platforms requiring only traditional banking effectively exclude a significant segment of digitally active populations.

Where Infrastructure Is Heading

The regulatory environment across Asia continues to mature: Hong Kong approved Bitcoin and Ethereum ETFs, Singapore’s licensing framework provides clarity, and Japan is bringing crypto under securities regulation. This regulatory development doesn’t slow innovation – it channels it into sustainable infrastructure.

Once deposit infrastructure is in place, new capabilities emerge: instant collateralization, cross-platform capital movement, and integrated treasury management for businesses with crypto revenue. Asia isn’t following Western markets in crypto adoption. It’s leading them.

EBC & Match2Pay: Crypto Deposits Made Easier

Crypto is quickly becoming the deposit method of choice for forward-thinking users who want flexibility, clarity, and speed. EBC Financial Group, as a global broker with offices in major financial hubs (including Tokyo, Sydney, Singapore, and Hong Kong), has noticed this shift. EBC is focused on serving clients where they are, with methods that are convenient for the modern trader, and that means offering cryptocurrencies as a payment method.

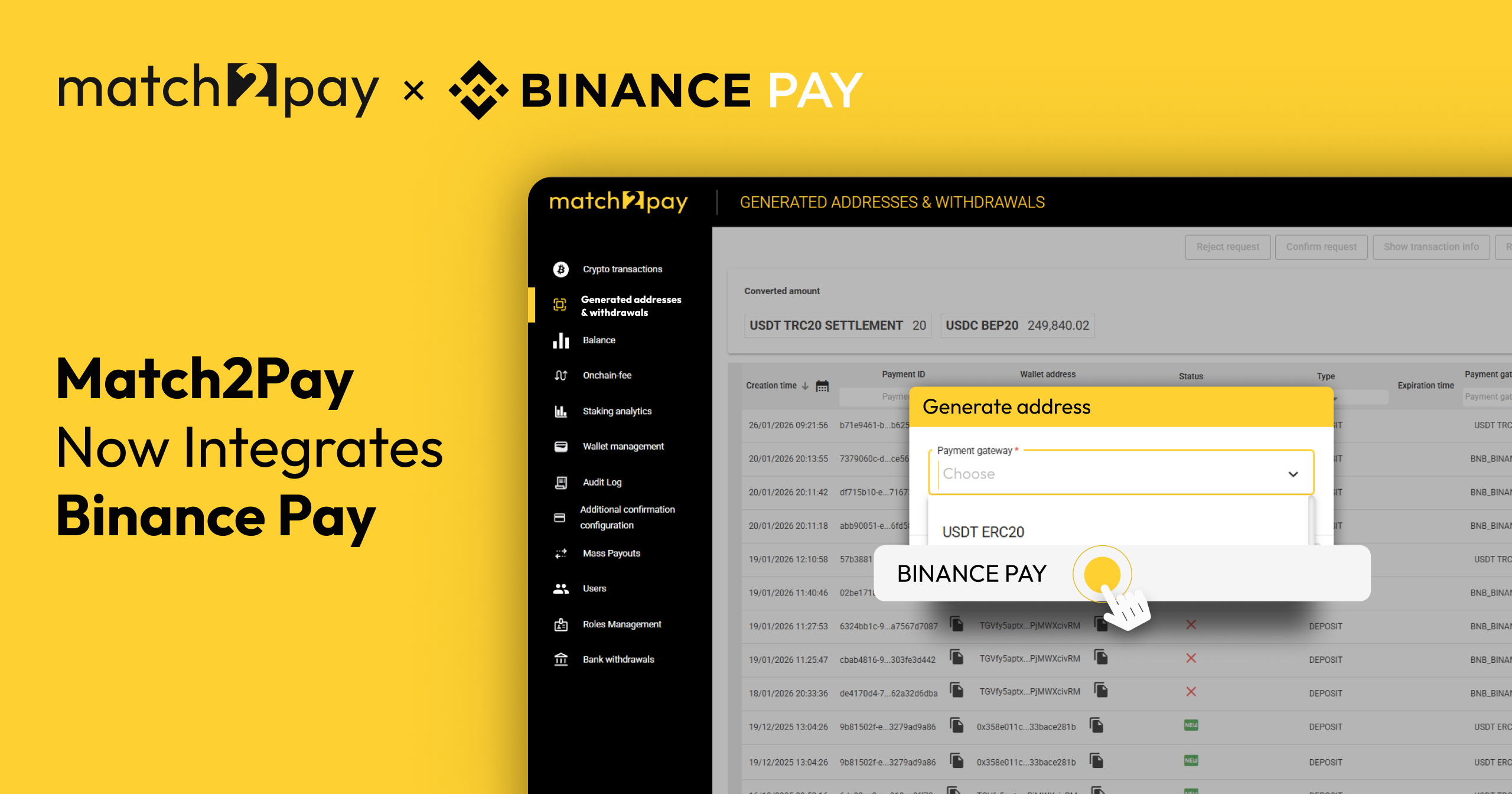

Through its strategic partnership with Match2Pay, EBC now offers clients the freedom to fund their accounts using multiple cryptocurrencies and stablecoins. It is all made possible through a secure, integrated payment gateway. Crucially, this system ensures transactions are handled safely and efficiently, with no need for EBC to store or manage clients’ crypto assets. This collaboration is all about giving traders more options and making it easier than ever to access global markets.

The process is straightforward: send your crypto to the provided address, and it’s converted and credited to your account, often in minutes rather than days.

What makes this work:

Speed that matches markets: Spot an opportunity Friday evening? Fund your account and execute your trade without waiting due to the standard bank operating hours. In volatile markets, timing matters.

- 24/7 availability: Unlike traditional banking with business hours and holidays, crypto deposits work around the clock. Sunday evening market move? You’re ready.

- Lower costs: Traditional payment methods charge 2–4% in fees. Crypto transaction costs are typically much lower, meaning more of your capital actually reaches your trading account.

- Security without custody concerns: EBC never holds your crypto directly. Match2Pay’s infrastructure handles conversions through a secure, integrated gateway. You get convenience without EBC taking on the complexity of cryptocurrency custody.

- Complete transparency: Track deposits in real-time, access detailed transaction histories, see clear fee breakdowns, and independently verify every transaction on the blockchain. No wondering where your funds are or when they’ll arrive.

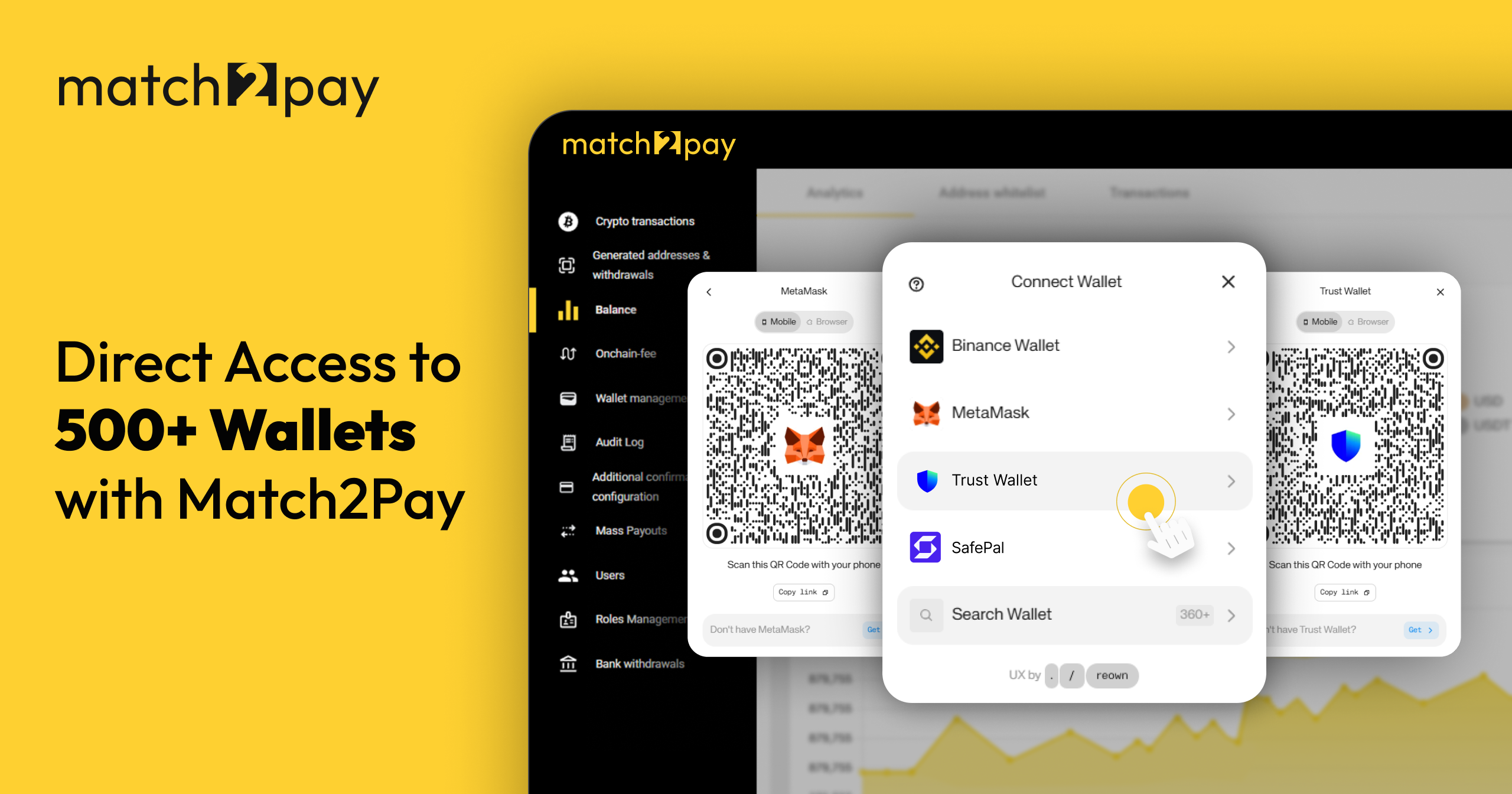

Why Match2Pay Is Perfect for Crypto Deposits

When it comes to managing crypto deposits, simplicity and control are key. Match2Pay delivers both, giving users a powerful suite of tools for effective payment processing. Here are some of its features:

- Analytics module: Access deposit and withdrawal statistics, transaction counts, and comprehensive reports to understand your payment activity.

- Transaction status and details: View complete information, including time, wallet address, and final currency for every transaction.

- Deposit and withdrawal requests: Monitor status, gateway information, and wallet destinations for all your funding activities.

- Detailed payment request information: See errors, status updates, amounts, and fee breakdowns for complete transparency.

- Address generation: Create new crypto wallets for deposits with gateway, amount, and currency selection.

- Balance viewing by currency: Track your holdings across different currencies, request funds conversion, and manage withdrawal requests to assigned hedge accounts.

- Payment page: Easily track transactions and verify them independently on the blockchain.

- System status page: Monitor system stability and transaction activities to ensure everything is running smoothly.

- 1:1 USDT to USD: Convert your USDT to USD at exactly the market rate with zero markup or hidden spreads.

- Auto token recovery: Automatically detect and recover tokens accidentally sent to the wrong blockchain network.

- Instant BTC confirmations: Get Bitcoin transactions confirmed without waiting for traditional blockchain confirmation.

- Enhanced security protocols on payouts: Protect every payout with five security layers: multi-signature wallet authorization, real-time fraud detection algorithms, IP whitelisting controls, 2FA requirements, and automated withdrawal limits with manual review thresholds.

- Custodial/non-custodial payment processing: Choose between custodial solutions where Match2Pay securely manages your private keys, or non-custodial solutions where you maintain full control of your wallets.

- Dedicated nodes and servers on each blockchain: Eliminate network congestion delays and ensure your payments are detected, verified, and processed at maximum speed.

The technical complexity happens in the background. You just see funds arriving in your trading account, ready to deploy.

What This Means for You

The USDT you receive from an international client? It can be deployed into a position within minutes. The stablecoins you hold as a USD hedge? They’re now instantly accessible trading capital, not just sitting in a wallet.

Markets move quickly. Having multiple funding options (traditional banking and crypto deposits) means you’re never caught waiting when opportunities appear. That Friday afternoon setup, that after-hours market move, that moment when you’d add to a position if you could move money faster: these are when instant funding creates real advantages.

As Asia continues to lead global crypto adoption through government program, blockchain remittance flows, and stablecoin integration, EBC’s Best Trading Platform (as recognized by Online Money Awards) embraces these payment methods to future-proof the trading experience, which global communities seek.

See How It Works

Want to learn more about Match2Pay? Join us at the upcoming iFX Hong Kong Expo, where our team will be available to answer all your questions and guide you through the benefits of crypto deposits.

Stop by our booth at 68. We’d be glad to show you how it works.

Disclaimer: This article reflects the observations of EBC Financial Group (SVG) LLC and is for reference only. It is not financial or investment advice. Trading in Contracts for Difference (CFDs) and foreign exchange (FX) involves significant risk of loss, potentially exceeding your initial investment. Before trading, you should carefully consider your financial status, investment objectives, expertise, and risk appetite, and consult an independent financial advisor if necessary, as EBC Financial Group and its global entities are not liable for any damages arising from reliance on this information.

(TRC20)

(TRC20) (BEP20)

(BEP20)